- Open Source CEO by Bill Kerr

- Posts

- Figure: Displacing Trust With Truth

Figure: Displacing Trust With Truth

How one company is building the everything exchange. 🚀

👋 Howdy to the 1,340 new legends who joined this week! You are now part of a 193,242 strong tribe outperforming the competition together.

LATEST POSTS 📚

If you’re new, not yet a subscriber, or just plain missed it, here are some of our recent editions.

🗝️ AI-Ready Growth Strategies For 2025. Seven levers to future-proof your growth today.

🦸♂️ From 150k Waitlist To $30 Million Series A. How Superpower cracked the code on accessible healthcare.

👀 Pattern Interrupt Marketing, What Is It? A stop you in your tracks style of attention grabbing and why you need to implement it.

PARTNERS 💫

Framer is giving early-stage startups a year of the Pro Plan—completely free.

Framer is the design-first web builder that helps startups launch fast. Join hundreds of YC founders already building on Framer. What you get with this deal:

Fast, professional site—no dev team needed. ✔️

Scales with your startup—from MVP to full site. ✔️

Spots are limited—apply before October 31st to claim your free year. *Pre-seed and seed-stage startups. New Framer users only.

Interested in sponsoring these emails? See our partnership options here.

HOUSEKEEPING 📨

I’ve been inspired by what TBPN has been doing lately. Just a few days ago they had a session where they spoke with Palmer Luckey, Brian Armstrong, and Brian Chesky on the show back to back to back. It’s quite inspiring, and although tech is quite niche in the grand scheme, they are well on their way to creating the ESPN for internet nerds.

And it lighting more of a fire under me to continue to expand the Open Source brand. I’d love to do more content overall, daily tech and business roundups, video content, deeper breakdowns of industry trends, leaning heavily into first party data like I did with this piece last year. Anyway, today’s piece is one I’m quite proud of. Figure reached out to me months ago to help them tell their story accompanying their IPO. This is the biggest company I have ever profiled by some margin. I hope you enjoy it!

ZERO TO ONE 🌱

Figure: Displacing Trust With Truth

Crypto, with its boom-and-bust cycles, snake oil projects, and shady frontmen (hello SBF), often gets frowned upon by the mainstream. Too many million-dollar monkey JPEGs and metaverse real estate scams for the average person to pay much heed. But a handful of companies are building real-world utility. If Web 1.0 brought us Google and Amazon, and Web 2.0 gave us Meta, Airbnb, and Uber, Web 3.0 will bring us comparable giants. The company we are profiling today may be on the fast track to being one of them.

You may or may not have heard of the blockchain-based lender Figure. Until recently, I hadn’t. But Figure is a company you should know. This is a company that IPO’d last month, founded and managed by a group of crypto-optimists who have been methodically building the financial future that you and I will live in. They are laying the rails on which money, if they have their way, will exist.

For me, this was a super fun piece to write. I wrote this piece as a crypto-sceptic, someone who sits in the middle of the bell curve with Bitcoin and blockchain products, and for the most part, I remain so. But I am not a sceptic on Figure. They are a company that, although it is not a household name today, likely will be tomorrow (figuratively speaking, excuse the pun).

To understand the company's history in preparation for this piece, I sat down to chat with Co-Founder & Executive Chairman Mike Cagney, and Head of Product at Figure Markets, Randy Myers. The story I unearthed was fascinating. Here is that story.

A little backstory

Figure was founded by serial entrepreneur Mike Cagney, his wife June Ou, and, as Mike’s IPO prospectus notes, “a handful of other like-minded individuals.” Mike’s previous gig was leading peer-to-peer lender SoFi, as their co-founder and CEO for the better part of a decade. Mike’s ‘aha moment’ for Figure came in 2017, when he began to see the power of blockchain to upend how financial services are done by “displacing trust with truth.”

Financial services, you see, are a little too ‘trusting.’ Traditional lending requires that banks, borrowers, and any other intermediaries fulfil their obligations. Things are very opaque; there are often dozens of gatekeepers and middlemen involved, and the interconnectedness (18 word score) of these assurances can amplify crises when things go wrong. Anyone who has seen The Big Short knows what I mean when I say this. Luckily—and thanks in no small part to Satoshi Nakamoto and his famous 2008 whitepaper—there is a better way: on-chain finance.

”The ability to create a native digital asset, where everyone knows true ownership, composition and history without trust,” Mike would say. “Where the asset can transact real time, bilaterally, without counterparty or settlement risk. Where lenders can get immediate and true digital perfection and control of collateral, blockchain completely reinvents how assets are originated, traded and financed.” And it makes sense for all the reasons below.

Factor | Traditional finance | Blockchain lending |

|---|---|---|

Authority | Centralized through banks, intermediaries. | Decentralized through code, consensus. |

Transparency | Low. Limited audibility over processes. | High. Even real-time visibility via blockchain. |

Human risk | Highly fraught with fraud, insolvency, mismanagement. | Low, although still present in code bugs or design flaws. |

Response time | Slow. Legal processes, reconciliations | Instant with autonomous execution via code. |

Auditability | Limited, but regulated | All transaction history is visible. |

It’s clear to every man and their dog that if we were building out the financial services industry today from scratch, we would not craft the type of system we operate under. There is incredible inertia to these legacy systems. But if these systems are like the near-immovable object, blockchain is the true unstoppable force that will blast through them. Mike saw this in 2017. But to totally paraphrase and butcher the words of German theoretical physicist and father of quantum theory, Max Planck: "Financial services, advance one funeral at a time.”

*His actual quote was “A new scientific truth does not triumph by convincing its opponents and making them see the light, but rather because its opponents eventually die, and a new generation grows up that is familiar with it.”

”We felt that you could originate, aggregate, and securitize loans on blockchain and save upwards of 85 bps of transaction costs. We made this pitch to the banks, and they universally said, “This is great! We love it! We’d like to be the 10th bank to do this,” Mike would recall. In short, although an 85 basis point discount to a 600 basis point margin is enormous, the banking system was not ready for this new reality. Not yet anyway.

So, how the HELOC did they do it?

Armed with the fire in the belly to upend the global norms of banking, the team at Figure needed a wedge. A toe-hold into a market that would allow them to slowly build up their know-how and create enough social proof to take back to the Patagonia-vested, Zyn-guzzling, finance nerds of Wall Street to show that blockchain was indeed the future of finance. That wedge: The home equity industry.

According to Mike, “We chose home equity line of credit (HELOC) as our initial product, as we felt no one was originating it efficiently, and we didn’t want to fight it out with the big personal lenders or mortgage originators while we convinced the buy and sell side to adopt this novel technology.” To break this down more clearly, Mike knew that, done right, they could take a ball-achingly arduous 45-day process and turn it into a glorious five-minute process application without any degradation in performance.

A massive win for someone looking to refinance their home to fund a worldwide trip, medical expenses for a loved one, or, in the case of Figure user Bailey Hall, converting an old barn into a blockbuster Airbnb. |

You could say goodbye to long and messy refinancing, and adios to losing your historically low interest rate. It was just access to your own equity in a simple, fast and effective way.

Oh, and for the most maximalist of Bitcoin maxis out there, of course, you can use Figure’s HELOC product to lend out three-quarters of your loungeroom to buy more Bitcoin. HODL.

Enter: Provenance Blockchain

While building out Figure’s HELOC product, the team started to chip away at the true end goal of pursuing what Mike could call “The exchange for everything.” Part of this mission would be to help collaborate in building a fully independent public blockchain, Provenance, on which Figure technology is built. This blockchain would function as a totally decentralized platform, with multiple independent stakeholders and validators contributing to control. The Provenance blockchain allowed for smart contracts to encode the full loan lifecycle, from origination to servicing to secondary. If Figure’s HELOC was the wedge, Provenance is the rail it rides on. Building on Provenance is a large part of why Figure could take a 45‑day HELOC process and make it near‑instant—without degrading credit performance.

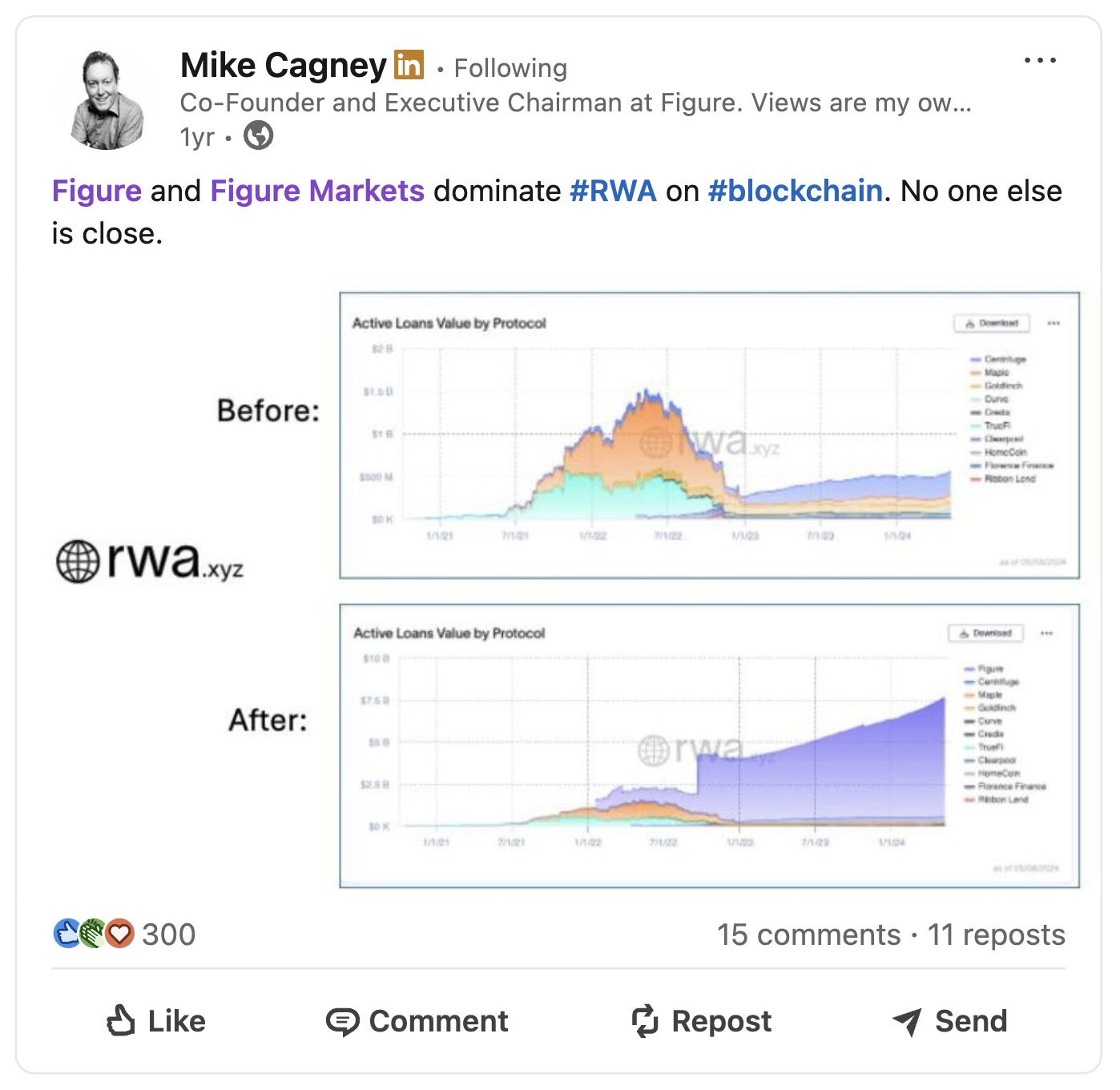

This, alongside Mike’s (and June’s) experience building SoFi to the behemoth it was, allowed Figure to skyrocket to where they are today; the number 1 non-bank mortgage lender in the world, putting about $600M of loans on chain each month with a total outstanding of about $11.9 billion buckaroonees.

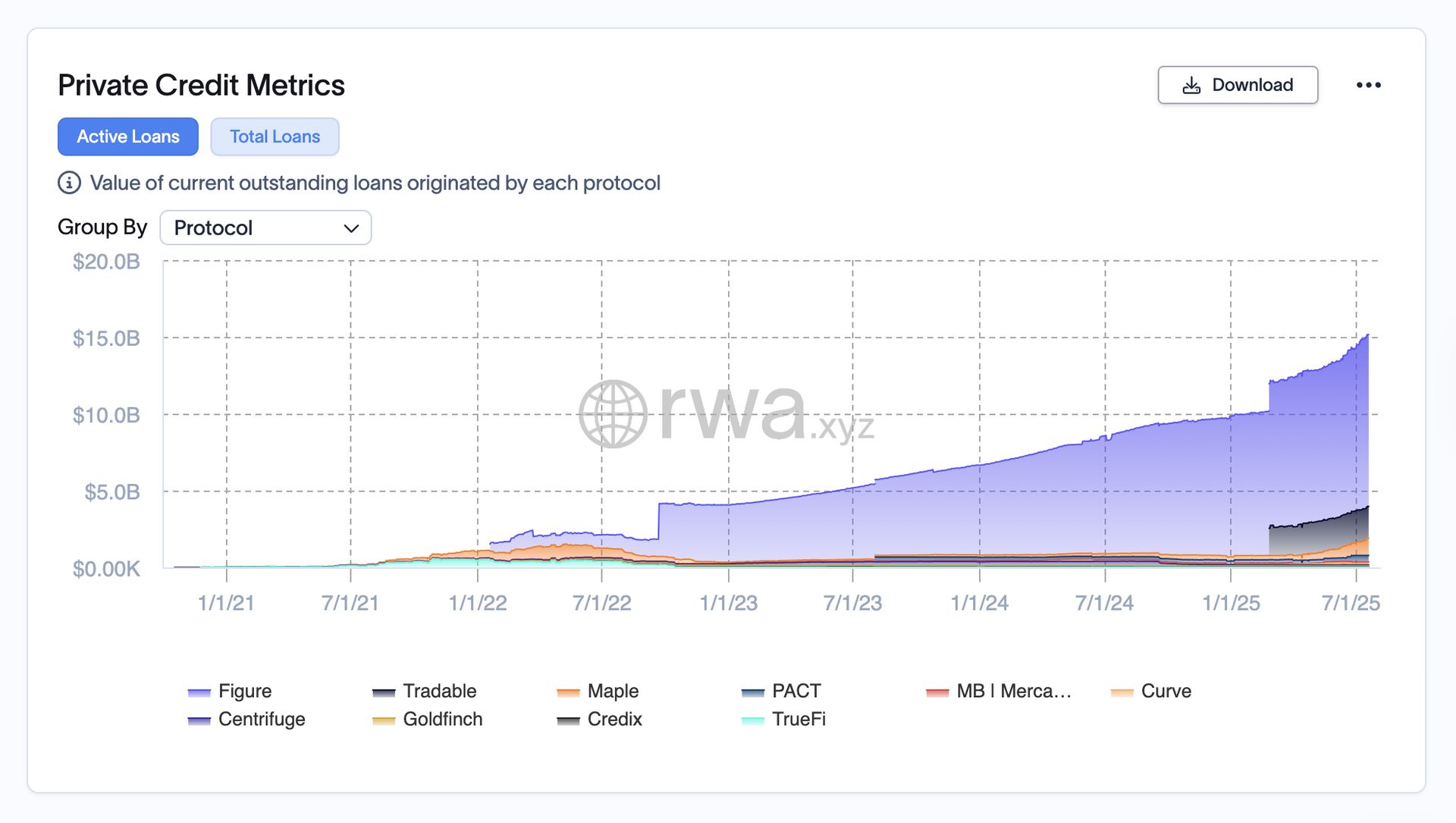

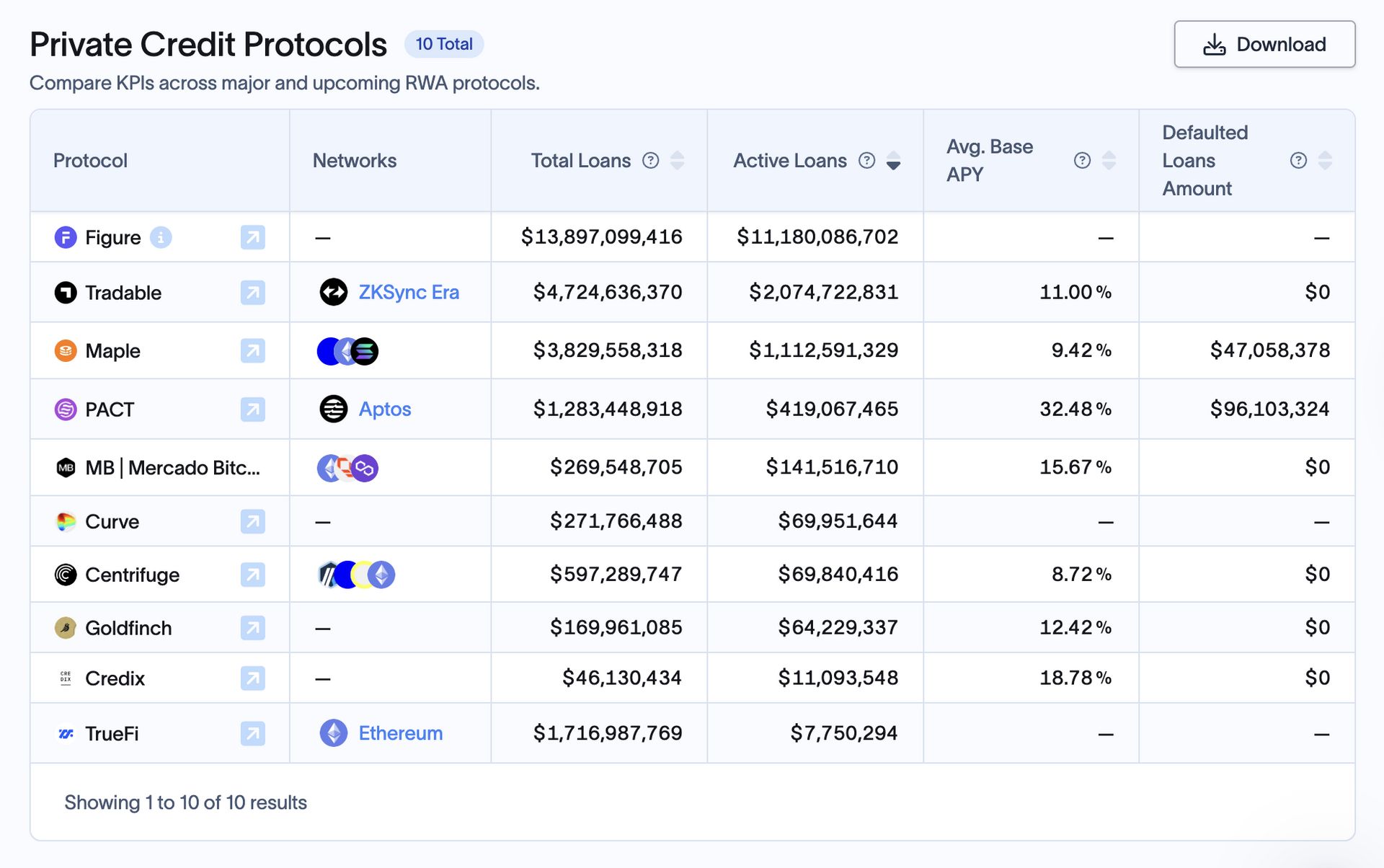

*You can also confirm TVL (Total Value Locked, or in layman’s terms, the total dollar value of cryptocurrency and other digital assets locked or deposited into smart contracts) on rwa.xyz with Figure leading the entire space.

Source: RWZ.xyz. |  Source: RWZ.xyz. |

Why does this all matter for the non-crypto bros amongst us? Well, Provenance compresses 100–125 bps of rent‑seeking middlemen—warehouse lines, trustees, custodians, reconciliation—into code, then passes the savings to borrowers. That cost kill, plus a real-time on-chain audit trail, is what got rating agencies, insurers, and big-ticket buyers comfortable doing business on-chain.

Biggest stats, boldest moves.

Provenance doesn’t follow, it leads.

— Provenance Blockchain Foundation (@provenancefdn)

12:34 PM • Jan 2, 2025

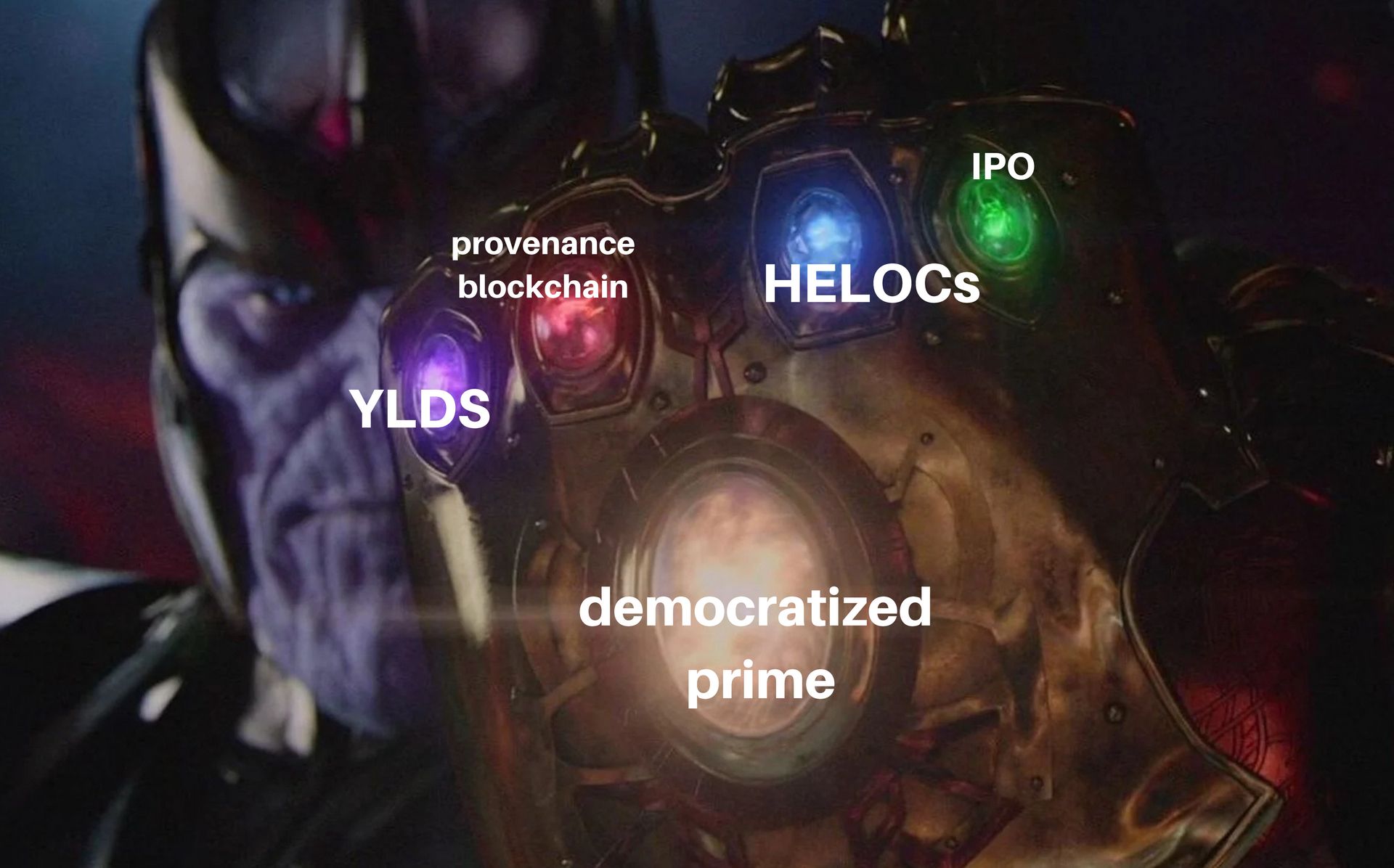

“When you displace trust with truth, you overhaul everything in markets, from trading to financing,” Mike would say. But they weren’t finished. With the shiny new rails built, and middlemen positively eviscerated, the obvious next step was a venue where those on‑chain assets could trade, finance, and compound. Something that would act as a self‑custodial exchange plugging real cash‑flows into modern market plumbing—the “exchange of everything” Cagney wants—for everyone.

Figure Markets, ‘The Everything Exchange’

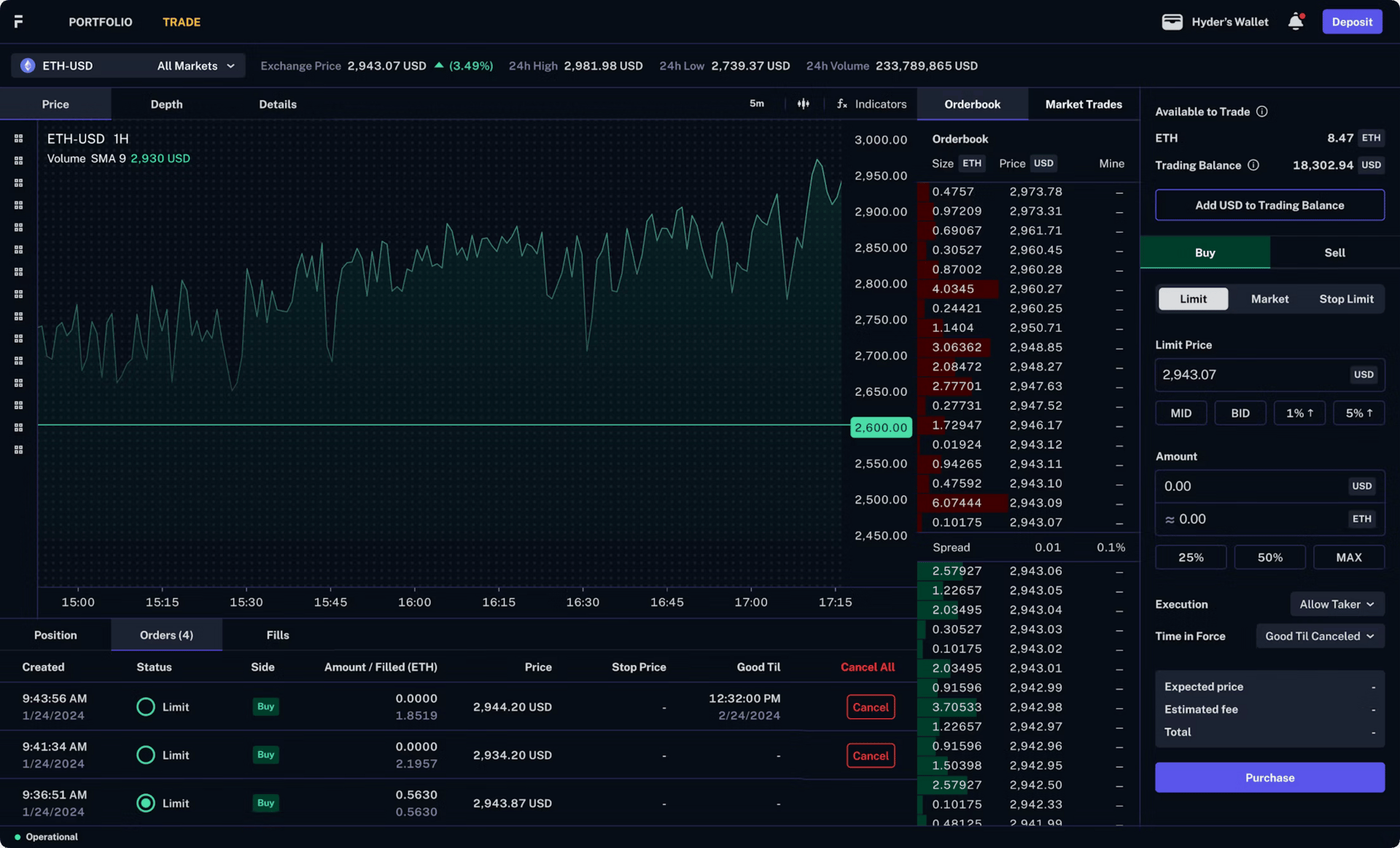

Figure’s next big move was the launch of Figure Markets, a self-custody cryptocurrency exchange that combines trading, borrowing, and earning features on a single platform. The idea was not to ‘build another Coinbase.’ It was to build an exchange natively wired to real cash‑flowing assets—and do it self‑custodied so FTX‑style omnibus‑wallet risk isn’t part of the bargain. Figure Markets runs on MPC wallets.

You can think of MPC, or Multi-Party Computation, wallets like a nuclear launch system that requires multiple keys to be turned simultaneously. No single person can launch it alone. The crypto world has seen what happens when one person holds all the keys: SBF was essentially a near nuclear holocaust for the industry, turning $32 billion into radioactive dust because FTX's centralized custody meant one man's gambling addiction could eradicate everyone's assets. A huge step forward for the nascent industry.

Source: Figure Markets.

Coming back to the everything exchange. There is a lot of Jeff Bezos about Mike Cagney. From the fact that they both saw a trend very early, and leaned hard into, to Bezos famous line (similar lines are oft spoken by Mike) that. “Your margin is my opportunity.” But I think for me, the biggest similarity is in the size and scope of the undertaking. The build of ‘the everything X.’

I asked Mike if he thought he was building the AWS of financial services, and although he basically bunted my original question squarely into the dirt, his answer actually helped paint the picture of Figure Markets in a really succinct way. Here it is without edits.

Bill: “Bezos said, 'Your margin is my opportunity.' You've cut 125 basis points from lending. Are you building the AWS of financial services?”

Mike: “I think it's consistent with that direction. We see three pillars of value proposition. The first is transactional efficiency. On the lending side, we've reduced over 100 basis points of costs through the origination, aggregation, and securitization of loans using blockchain technology.

The second pillar is liquidity—the ability to run marketplaces with certainty. For example, we run regular loan marketplaces where our origination partners (we have over 170 of them) can access capital markets directly through bid-wanted-in-competition or offer-wanted-in-competition auction processes. The combination of knowing for certain that the loan is authentic on-chain and knowing its history, performance, and prepayment information allows those loans to trade real-time as digital assets. This has never happened before. The only liquid marketplaces for loans have been Fannie Mae and Freddie Mac mortgages. Through blockchain, we've brought that liquidity to the market, which has been a huge benefit to our partners. |

The third pillar is financing. Because the asset is on-chain, because I can get direct security and perfected interest in it, and because I can liquidate it directly, I don't have to trust that a custodian is holding the asset or worry about double pledging. This opens up direct asset-based lending, where I can assess liquidity and volatility to determine my risk as a lender.

This unlocks tremendous value by directly connecting sources and uses of capital. You can see this on platforms like Aave, where there's about $8 billion of stablecoin deposits. I can borrow against crypto there at around 6.5%. In wholesale capital markets, if I went to Cantor or someone else, that loan would cost at least 9.5%, maybe more.

Why is DeFi more efficient? It's a Pareto condition where both parties are better off. The lender is better off because they were getting nothing before, and now they're getting five or six percent. The borrower is better off because they're not paying all the overhead of banks as capital allocators. Banks aren't efficient capital allocators, even though that should be their role. There's huge overhead that you pay for as a borrower. By directly connecting sources and uses of capital, you unlock something really unique and efficient that benefits both sides. That DeFi construct is the most powerful part of blockchain, which is why we created Democratized Prime (more on this later).”

Source: Mike’s LinkedIn. |  Mike at investor event. |

For those crypto normies (and minis) out there, the idea of Figure Markets is this: A platform where you can trade crypto, borrow cash against your Bitcoin or Ethereum without selling it, and earn yield on idle assets. All while maintaining complete self-custody through MPC wallets. Think of it as combining the best parts of Coinbase (easy trading), Aave (borrowing against crypto), and traditional banking (earning yield), but without ever giving up control of your assets to a polygamous, malevolent nut-job like Bankman-Fried. But if the Figure Markets is the sundae, then their new product, Democratized Prime, is the cherry on top.

Brought to you by Attio—the AI-native CRM.

Connect your email, and you’ll instantly get a CRM with enriched customer insights and a platform that grows with your business.

With AI at the core, Attio lets you:

Prospect and route leads with research agents

Get real-time insights during customer calls

Build powerful automations for your complex workflows

Join industry leaders like Granola, Taskrabbit, Flatfile and more.

Interested in sponsoring these emails? See our partnership options here.

A quick scorecard

I mentioned at the top that Figure was building real-world utility with everything they do. But we’ve not really paused to take a breath, zoom out, and look at the big picture yet. So let’s do that.

The highlight | Then when | The what |

|---|---|---|

Company founding by Mike Cagney & June Ou | 2018 | Former SoFi team’s new venture to transform financial services through blockchain. |

First $1 billion in loans originated | 2020 | Rapid growth and product-market fit, validating blockchain lending. |

$150M HELOC securitization on blockchain | March 2020 | Industry first: Complete securitization process managed entirely on blockchain (Provenance), from origination to bond issuance. |

Achieved $5B+ in HELOC originations | Close of 2020 | Industry first: Complete securitization process managed entirely on blockchain (Provenance), from origination to bond issuance. |

First rated HELOC securitization (AAA rating) | April 2023 | FIGRE 2023-HE1 received AAA rating from DBRS Morningstar, validating institutional confidence. |

Raised $300M in credit facilities | 2023 | Enabled further capital access and growth capacity for lending operations. |

Spun out Figure Markets | March 2024 | Created standalone entity for crypto exchange and digital assets with $60M funding from Jump Crypto and Pantera. |

Appointed Michael Tannenbaum as CEO | April 2024 | Former Brex COO and SoFi CRO brought in to lead operations while Cagney became Executive Chairman. |

Honestly, this next one seems like kind of a big deal…

The highlight | Then when | The what |

|---|---|---|

June 2025 | First blockchain-based securitization to receive S&P ratings across all bond classes (AAA to B-). |

Why? Well, the S&P AAA wasn’t just a gold star; it was the institutional permission slip that the world of blockchain finance has been chasing for over a decade. It told the world's most prominent money managers: this is safe, scalable, and real. And for Figure, it unlocked the credibility to go from quirky fintech to a legitimate Wall Street-plus-blockchain hybrid.

The highlight | Then when | The what |

|---|---|---|

Merged with Figure Markets | July 2025 | Reunified companies to create comprehensive blockchain capital markets platform. |

Achieved profitability | H1 2025 | $29M net income on $191M revenue with 30%+ adjusted EBITDA margins, proving business model viability. |

Filed for IPO | August 2025 | Filed S-1 for Nasdaq listing under ticker "FIGR" with Goldman Sachs, JPMorgan, and Jefferies as underwriters. |

As you can see, when I mentioned they weren’t just another Bored Ape Yacht Club, I meant it. Figure is building the financial backbone of the new economy. And taking all the records along the way.

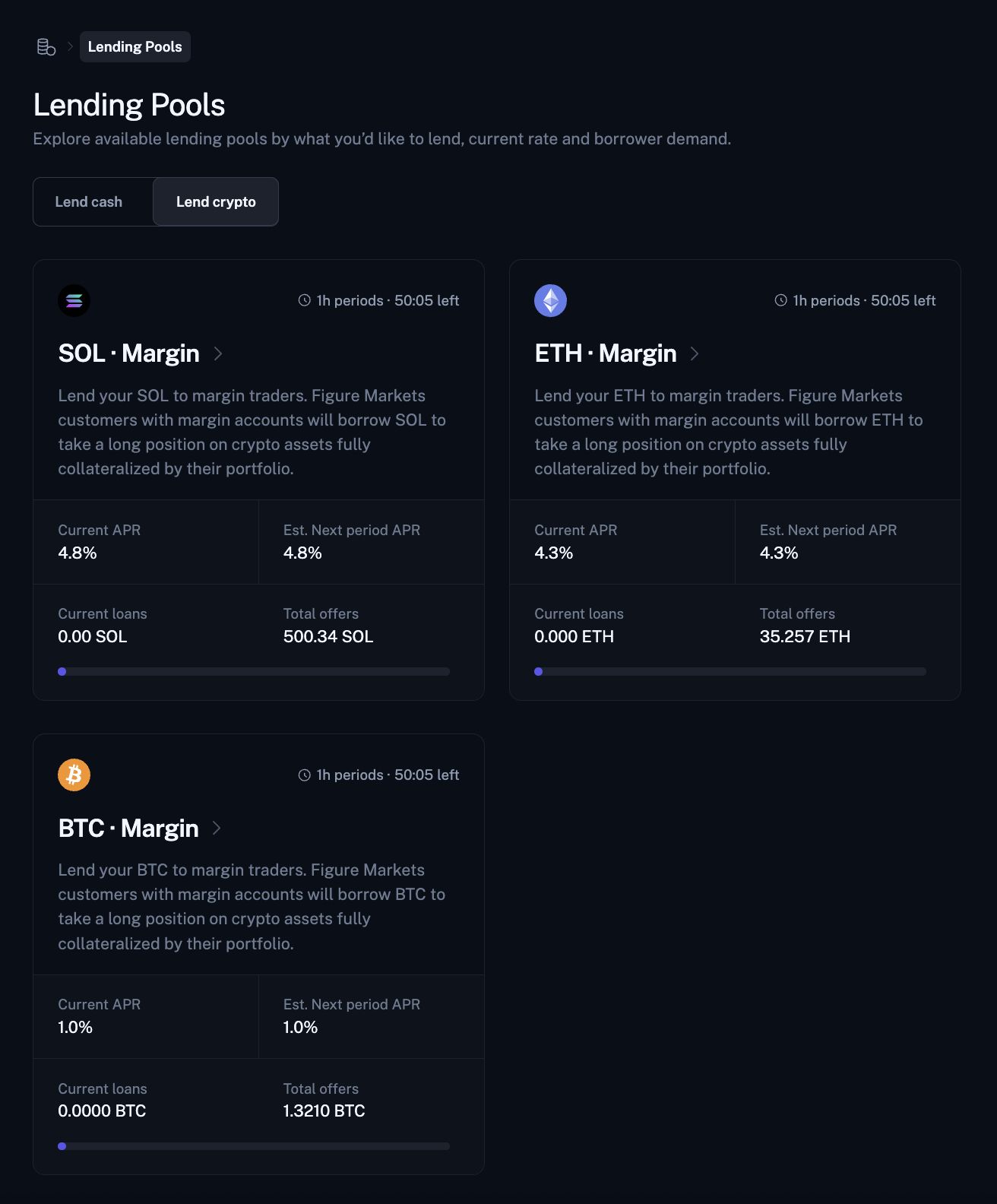

Real world assets + 8.5% return = Democratized Prime

After my conversations with the entire Figure team, researching the industry, and using my own common sense, one thing became clear to me: their new product, Democratized Prime, may be their crowning achievement. Or at the very least, their next massive growth lever. As much as it sounds like an idealistic Autobot, it’s actually much more than that.

Democratized Prime is levelling the playing field for lending and borrowing in a way that the market never allowed you to do before,” Mike would tell me. “And not just for things like crypto, but for any digital asset class. I think what we're really trying to do is bring DeFi to the masses, and in doing that, you can't limit yourself to crypto. You've got to open it up to any digital asset. I hope that's where we make our biggest mark.”

*Now, before we move on, I’d like to help those out there whose brain works like mine, and cannot think of Democratized Prime without thinking of the leader of the Autobots, Optimus Prime. For those of us whose brain works in this way, I built this simple comparison chart.

Category | Democratized Prime (0–10) | Optimus Prime (0–10) | Edge |

|---|---|---|---|

Yield potential | 9 | 0 | Democratized Prime |

Self‑custody vibes | 9 | 1 | Democratized Prime |

Truck mode | 0 | 10 | Optimus Prime |

Regulatory friendliness | 9 | 2 | Democratized Prime |

On‑chain transparency | 10 | 0 | Democratized Prime |

Heroic one‑liners | 3 | 10 | Optimus Prime |

Portfolio protection | 8 | 4 | Democratized Prime |

Total | 49 | 36 | Democratized Prime wins |

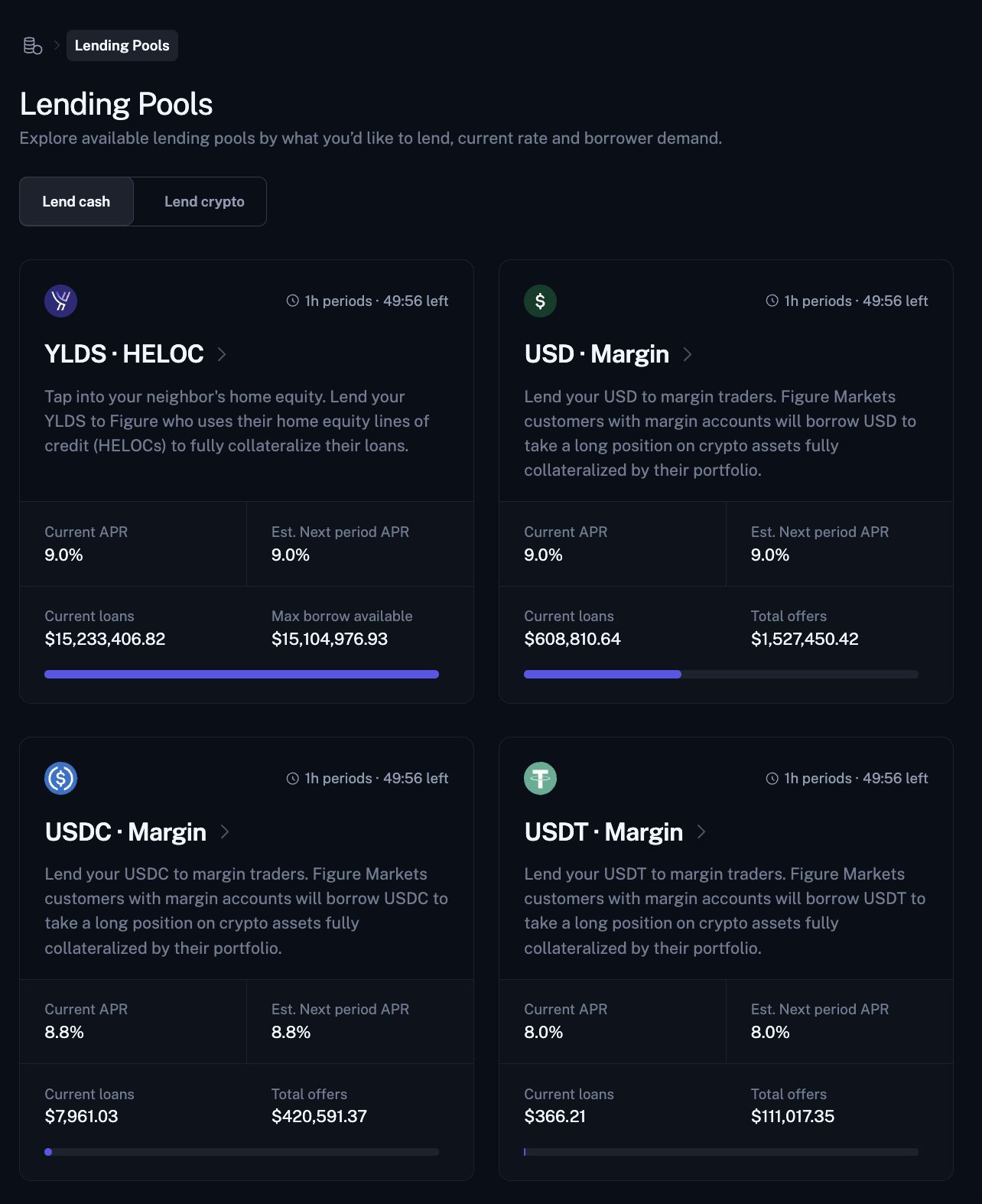

But what is Democratized Prime, and how does it work? The TL;DR is that you can think of it as private credit investment opportunities brought to the public. One that any investor can tap into, where your money is backed by real-world assets, and you can withdraw every hour on the hour. To dig a bit deeper: Lenders in the HELOC pool (everyday investors or institutions) add YLDS—Figure’s SEC‑registered, interest‑bearing stablecoin alternative—into a shared pool, which earns a base rate. That short‑term ‘overnight’ rate is the rate banks use (SOFR) minus 0.35 percentage points. So if the rates were 5.0%, you’d earn about 4.65% while you’re in line.

Source: Figure Markets. |  Source: Figure Markets. |

But that’s only the ‘waiting in line’ part. When you’re matched—that is, your offer to lend is accepted in the hourly auction—you switch to earning that hour’s market rate, aiming around ~8.5% in the HELOC pool. This is paid from the cash flows generated on a bundle of established, home equity loans. Figure already originated and recorded on Provenance. In other words, this whole pool is backed by real monthly payments, not hype.

Under the hood, it’s an hourly Dutch auction: supply (offers) meets demand (borrowers). If there aren’t many offers, the rate rises to attract more liquidity. If there are plenty, the rate falls. You can withdraw at any hour as long as there are new lenders queued (these are called ‘resting bids,’ I am told). If not, you wait for the next hour to clear.

When we get to a place where anybody who is an originator can pledge those loans and borrow against them and use that for working capital, then we've really eliminated a huge toll booth and everybody's happy.

Here’s the punchline: for the first time, regular savers can aim for something close to a bank’s spread without being a bank. You park cash as YLDS, earning while you’re waiting in the queue, and when you lend against Figure’s pool of home‑equity loans, your rate steps up toward ~8.5%, all paid from genuine mortgage interest, not tokens. Withdrawals run on the hour when fresh bids are waiting, and the collateral sits on‑chain so you can actually see what you’re lending against. Das ist gut.

Source: Figure S-1.

”Who is this product designed for?” I asked Randy in our interview. He told me they have three cohorts they are targeting. “The first is the FIRE cohort. The financial independence, retire early crowd. The reason is that these people are looking for decent risk-adjusted returns without volatility risk suddenly draining their portfolio, and all of a sudden, they have to go back to work.”

Next was ‘TradFI’ (aka traditional finance): “They will understand what we're doing immediately. They'll know what a decentralized warehouse line of credit is. They're high-net-worth individuals, like the banker bros. They probably have cash that's sitting on the sidelines at 4% or 4.5%, and thinking, ‘This is silly, I should upgrade my dry powder.’ They want to go into something that offers a higher return, or replace their fixed income portfolio, which many of them probably have as well.”

”The third is the crypto yield farming and fixed income people. Those already exploring fixed-income and yield opportunities. They're either on the yield farming side in crypto, abandoning the risk side, and opting for 20%, 30% pools that are very high-risk. Or you're going after like the junk ETF on TradFi rails. That's got around a 14% return, but it carries extreme NASDAQ volatility risk, just like junk bonds have equity volatility risk. From a risk-adjusted return rate, we think that ours is higher from an equilibrium, effective value perspective.”

The bigger story here, though, is what this unlocks in the future. Democratized Prime takes the old ‘warehouse line’ that only banks could tap and turns it into a transparent market: originators pledge loans, borrow against them, and keep funding more credit. HELOCs come first, next you could have autos and student loans. You don’t just create a new product; you change the cost of capital entirely.

Next, I want us to take a walk down memory lane, to what is now referred to as the Global Financial Crisis, and what—if these rails had existed in 2008—that particularly messy meltdown may have looked like. Let’s stress‑test.

Figure vs The Great Financial Crisis of ‘08

The year is 2008. The U.S. has just crowned its first black president, Michael Phelps is dominating with eight gold medals at the Beijing Olympics, and Heath Ledger has delivered a performance of a lifetime in Christopher Nolan’s film of the year, The Dark Knight. Oh, and the global financial markets are on the verge of imploding.

But did the Wall Street dirty dogs that caused the Global Financial Crisis really have to do us like that? Maybe. But maybe not. If we jumped into Doc Brown’s DeLorean to scoot ourselves back to the last major crisis—the tech bubble bursting at the turn of the century—to launch Figure-style on-chain lending, by 2008, things might have turned out very differently.

Sure, asset prices were likely to fall either way due to the numerous risky loans on the books, but when you “displace trust with truth,” as Mike puts it, you lift the fog surrounding these shady practices.

Firstly, each loan would be assigned a unique ID and a simple record that updates when payments are made or missed. An investor—or a regulator—can click from a bond down to the exact loans inside it and see what’s going on this week, not months later.

Second, there is clear ownership on-chain. It’s clear and transparent to see who owns a loan and who has used it as collateral. It’s much harder to pledge the same collateral twice without the market being aware of it. You can trace the path from the real‑world loan to the digital bundle and back again. Tomfoolery begone!

And lastly, funding also changes. In 2008, short-term credit froze, setting off a chain reaction. In Figure’s world, warehouse funding clears in hourly auctions on Democratized Prime. If cash is scarce, rates rise to attract new lenders; when money is plentiful, rates fall. Lenders can exit at any time when new bids are waiting. This is not a magic bullet—liquidity can still get tight—but the system tries to pull capital in rather than forcing a run on the bank (like the last meaningful run pictured below).

YOU SHOULD BE ABSOLUTELY TERRIFIED RIGHT NOW — THAT IS THE PROPER REACTION TO A BANK RUN & CONTAGION

@POTUS & @SecYellen MUST GET ON TV TOMORROW AND GUARANTEE ALL DEPOSITS UP TO $10M OR THIS WILL SPIRAL INTO CHAOS

— @jason (@Jason)

5:44 AM • Mar 12, 2023

Would Figure-ified finance have erased the crisis? Maybe not, even within that small hypothetical time window. However, it would undoubtedly have changed the blast radius. And if on-chain lending becomes the go-to system of record for financial services, with facts living on the blockchain, and funding clearing in the open, you certainly get a milder, earlier shock to the markets the next time they do make a turn for the worse.

Skeptics’ corner / Not financial advice

*Note: The graphics in this section are a hypothetical illustration created for educational purposes only. They do not reflect actual historical data, past performance, or future projections. Assumptions are simplified for demonstration and do not account for fees, taxes, or market variability. Investing involves risk, including possible loss of principal.

If you are like me and most other capitalists on Planet Earth, you probably like money. If not for the Dom Perignon, Yeezys, or the Bezos mega-yachts, at least for financial freedom. The security of having your bills paid on time, and working towards owning your own place.

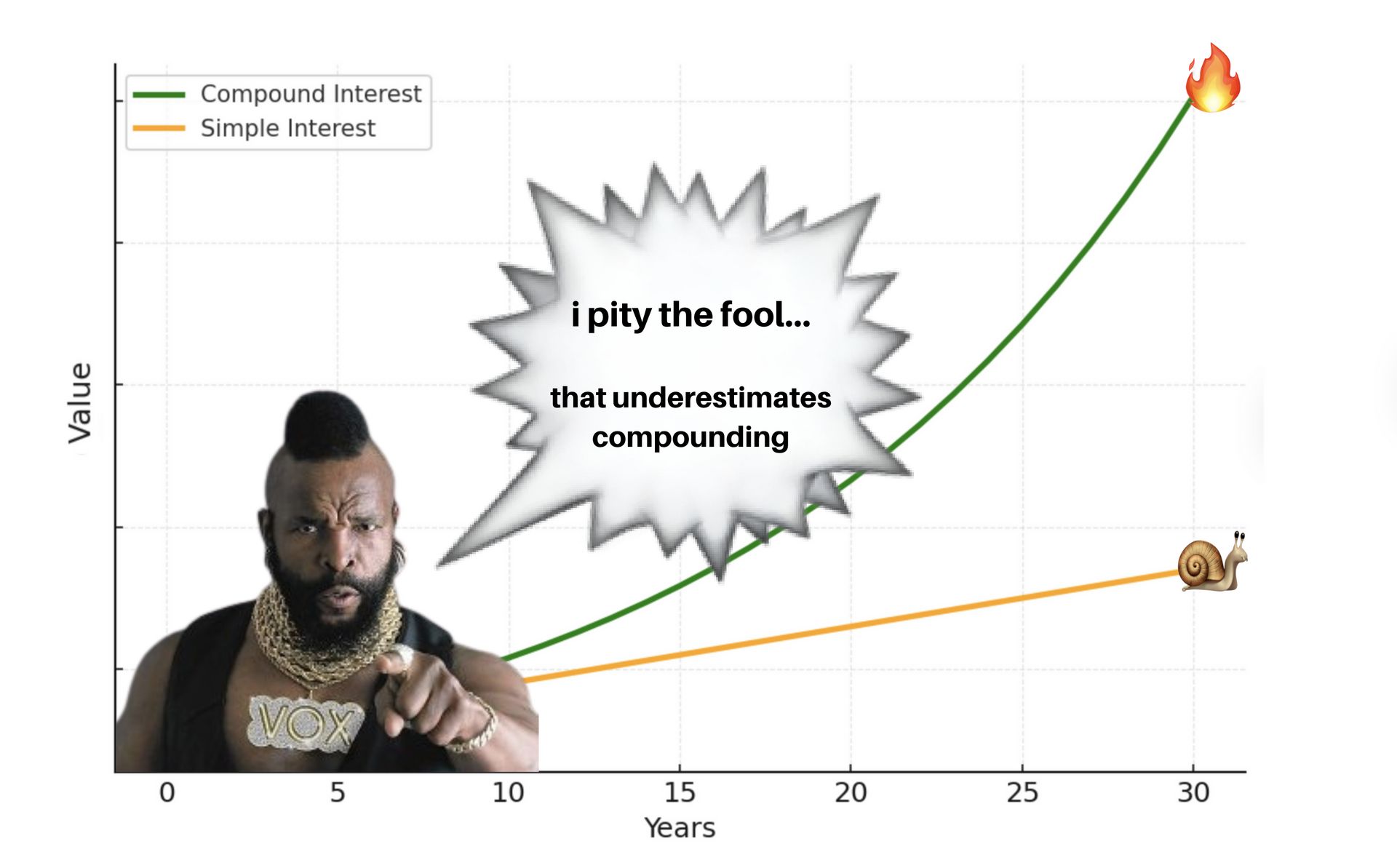

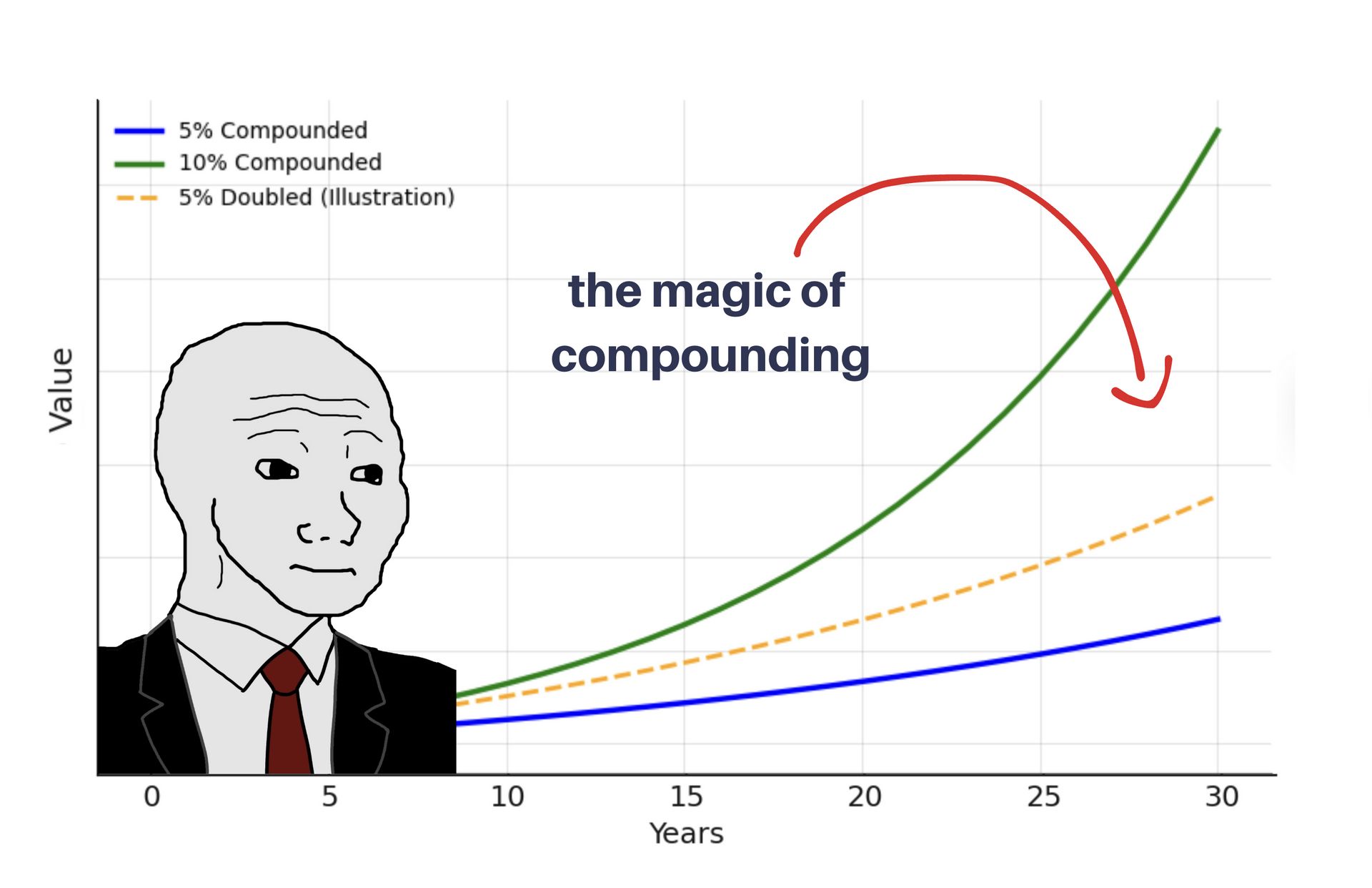

How does the average punter get there, though? Financial freedom? Well, you are either a trust fund baby, hit it rich by founding (or joining early) a successful company, or you have worked really hard and invested wisely for a sustained period of time. If you are the latter, the invested wisely part is critical. It was rumored to be Einstein who said, "Compound interest is the eighth wonder of the world. He who understands it, earns it. He who doesn't...pays it,” and it really is.

People often assume that if you double your return, you’ll double your money. That’s not how compounding works. Let’s say you earn 5% a year on $10,000. After 30 years, you’ll have around $43,000. Pretty neat.

Now double that return to 10% a year. You might expect to end up with $86,000, right? Wrong. You’ll actually finish with about $175,000—four times more, not two. That’s the magic (and menace) of compounding: it doesn’t just stack, it accelerates. Every year, you earn interest not only on your original money, but on all the interest that came before it.

Recently, I open-sourced my investment portfolio. I have 60% of my portfolio allocated to market-tracking ETFs, which provide steady, reliable returns. 30% goes to funds and accelerator investment at Startmate and Blackbird. Less stable, kind of a roll of the dice (but not really, as both rank pretty high in global fund returns), with 10% to angel investment and Bitcoin.

In all the areas where I invest, aiming for an 8.5% return usually means I will be at the mercy of the Gods of Volatility. I am going to have my heart broken once in every three years, and I may or may not hit 8.5%. Since its inception, the S&P 500 has averaged ~10.3%. Long-term U.S. bonds (10-year) are currently paying 4.25%, my bank is paying 4.6%.

Now for the skeptics’ corner…

Interestingly enough, as I was about to finish my discussion with Randy, I asked him what I should have asked him in the interview. If there was anything he’d like to add effectively.

And he said, “Yes, in fairness, this isn’t risk-free. I mean, nothing's really risk-free. And I think there are two risks. One, if the loans default, which isn't that often, really at all.” |  Always one tariff away. |

He went on to say, “You could actually see all of the creditworthiness on the HELOC pool page on Democratized Prime. So if you go to Democratized Prime, go to the HELOC pool, and you scroll down on the website, you'll see 20-plus different stats about all the collateral in that pool. So we are already transparent. You can see all of those and feel comfortable about the loans that you're lending against.”

”The other side of this is the liquidity. You have hourly liquidity and hourly roles in the Dutch auction, but you can only get out if bids are sitting on the sidelines. Of course, there will be bids sitting on the sideline because if you want to get out and you can't, then the rate will go higher. And there's going to be hedge funds and all those other players that are happy to say, ‘Yeah, I'll give you your cash at 15%.”

So, like anything, Figure Market’s new flagship comes with risk.

Playbook / how you can apply this

So what would you take away from the Figure story? Where did they find opportunities that their competitors—or in this case, the incumbents—were lacking? Here are a few below.

Recruit the team that’s done it before: Mike and June had worked together on the highly successful SoFi, and so had a number of the early team members. Huge derisking of human capital.

Own the rails that tax your users: Figure didn’t wait for incumbents to adopt on-chain workflows; it built Provenance, which is now an independent + public blockchain, captured 100–125 basis points of waste, and recycled it into a price advantage. Bezos’ “your margin is my opportunity,” in full effect.

Be your first enterprise customer: Banks wanted to see proof played out, so Figure originated the loans itself to de‑risk the system and prove liquidity.

Compliance as distribution: Register the thing no one else has the patience to (e.g., YLDS), then use it as the staging asset across your products. Regulation becomes your moat.

Dual‑track go‑to‑market: Quietly build out your B2B volume engine; then later add a consumer narrative once the exchange and lending pool exist. Brand after proof.

Ship → segment: Start with one interface; quickly split retail / ‘pro‑tail’ / institutional views, plus APIs for portfolio managers.

Reg‑lexicon storytelling: Talk in basis points, SEC filings, and audited ratings. For the crypto industry that is still in its infancy, this approach can help dispel any fears and disarm critics of the model.

The future of Figure

Figure’s story is less about crypto and more about shortcutting Wall Street tolls. Provenance stripped out over a point of securitization costs; Figure Markets removed the exchange custodian; Democratized Prime now removes the bank warehouse line. Each slice of middleman shrink‑wrap gets recycled into either lower loan rates or higher saver yields. It’s a win-win-loss, with the only loss being to those who no longer provide any tangible value to the exchange.

If the flywheel keeps spinning—and regulators remain comfortable—a future homeowner could apply, fund, securitize, and refinance their mortgage, and park their spare cash at 9%, all within one app, all on one transparent ledger. A full‑stack capital‑markets platform (origination → exchange → custody). The ‘Nasdaq of real-world assets.’

And a far cry from dorky fax machines, wet‑ink signatures, and 48‑hour ACH transfers. The future of financial services is right there for the taking. And Mike, Jun,e and the Figure team are ready to reach right out and grab it.

Extra reading / learning

Fast Company, Most Innovative Companies - March, 2025

“I turned a tiny barn into a blockbuster Airbnb” - June, 2025

Figure’s SEC S-1 Filing - July, 2025

Figure’s IPO filing marks Mike Cagney’s return to public markets - August, 2025

And that’s it! You can follow Mike and Randy on LinkedIn, and also check out Figure and Figure Markets on their websites to learn more.

BRAIN FOOD 🧠

TWEETS OF THE WEEK 🐣

Deel went from a $60M valuation to $17.3B in 6 years

-$1B+ ARR in 6 years

-16% EBITDA margins

-Would have the highest Rule of X Score of any public company

-2026 IPO candidateForget “time to $100M”. How fast can you get to $1B?

— OnlyCFO (@OnlyCFO)

1:25 PM • Oct 20, 2025

the not boring campaigns of the week

— calvin (@calvintcarr)

6:36 PM • Oct 20, 2025

"$2M ARR in three months used to be impressive. Now we expect it within ten days. Right now, momentum is the only moat."

I may be a dullard, but there is something I don't understand.

AI companies, sure, they can be lean, mean, revenue-generating machines—but what is the

— Bill Kerr (@bill_kerrrrr)

1:00 PM • Oct 17, 2025

TOOLS WE RECOMMEND 🛠️

Every week, we highlight tools we like and those we actually use inside our business and give them an honest review. Today, we are highlighting Superpower*—a tool used by founders, leaders, athletes and more to optimise their health using AI.

See the full set of tools we use inside of Athyna & Open Source CEO here.

HOW I CAN HELP 🥳

P.S. Want to work together?

Hiring global talent: If you’re hiring tech, business or ops talent and want to do it 80% less, check out my startup, Athyna. 🌏

See my tech stack: Find our suite of tools & resources for both this newsletter and Athyna here. 🧰

Reach an audience of tech leaders: Advertise with us if you want to get in front of founders, investors and leaders in tech. 👀

|

Disclosure: This article was written in collaboration with Figure Markets, and I received compensation for it. The views expressed are mine alone. Full product/disclosure materials from Figure Markets are available here.

Reply