- Open Source CEO by Bill Kerr

- Posts

- The Future Of Technology Belongs To One Man, Jensen Huang

The Future Of Technology Belongs To One Man, Jensen Huang

Co-Founder, President & CEO of Nvidia, the man holding all the chips. 🍟

👋 Howdy to the 1,863 new legends who joined this week! You are now part of a 216,350 strong tribe outperforming the competition together.

LATEST POSTS 📚

If you’re new, not yet a subscriber, or just plain missed it, here are some of our recent editions.

💘 How Self-Awareness Became The Ultimate Edge. An interview with Jerry Colonna, Co-Founder & CEO at Reboot.

📣 A Guide To Crafting Your Brand Voice. A step-by-step guide on creating a tone & identity your audience will love.

🏎️ If You Ain't AI First, You're Last. A behind-the-scenes founder’s guide to your AI transition.

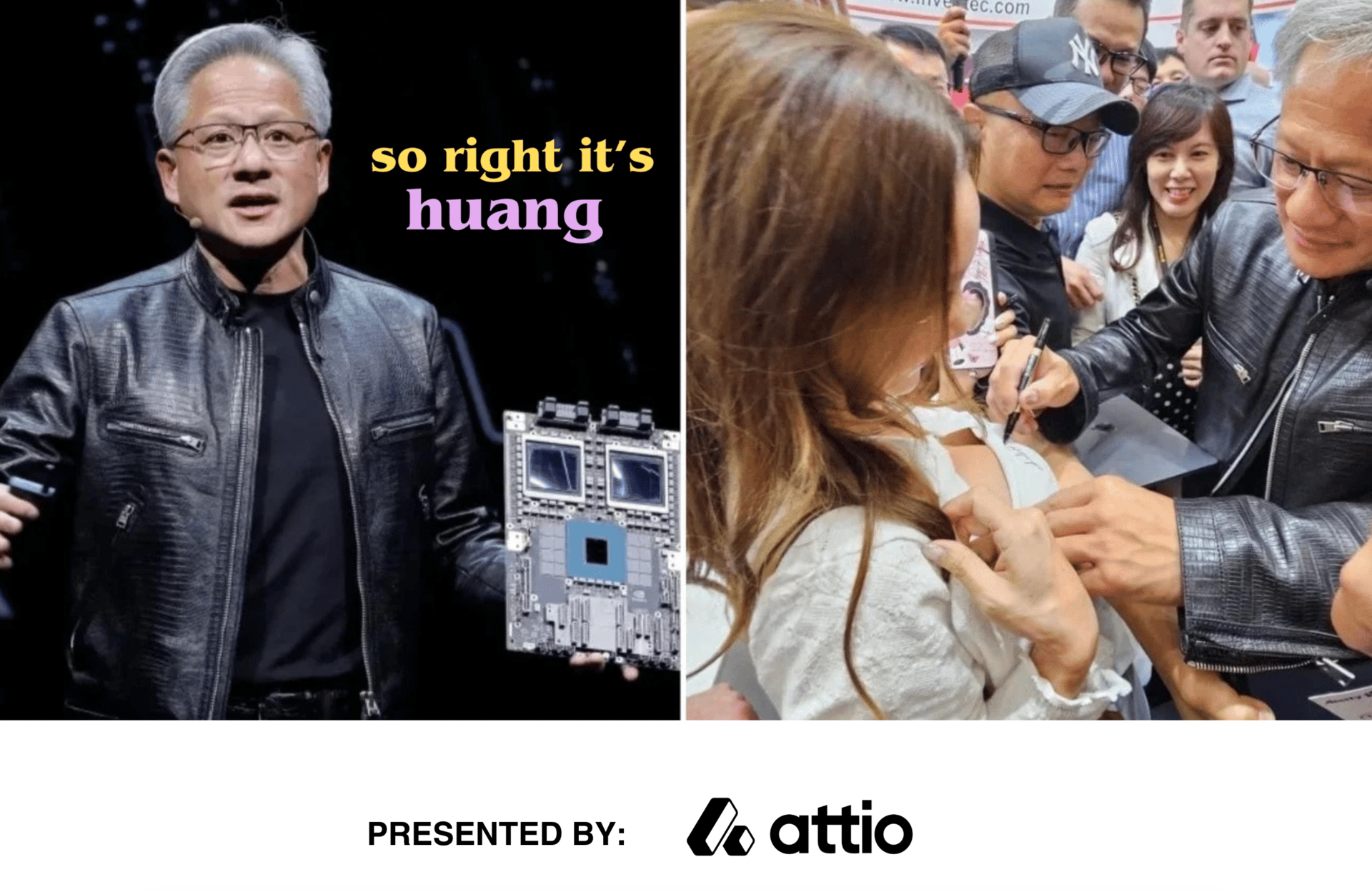

PARTNERS 💫

Attio is the AI-native CRM for your team.

Connect your email and calendar, and Attio instantly builds a CRM that matches your business model—with all your companies, contacts, and interactions enriched with actionable insights.

With Attio, AI isn’t just a feature - it’s the foundation. You can do things like:

Instantly prospect and route leads with research agents

Get real-time insights from AI during customer conversations

And build powerful AI automations for your most complex workflows

Industry leaders like Taskrabbit, Granola, Flatfile, and more are already experiencing what’s next.

Interested in sponsoring these emails? See our partnership options here.

HOUSEKEEPING 📨

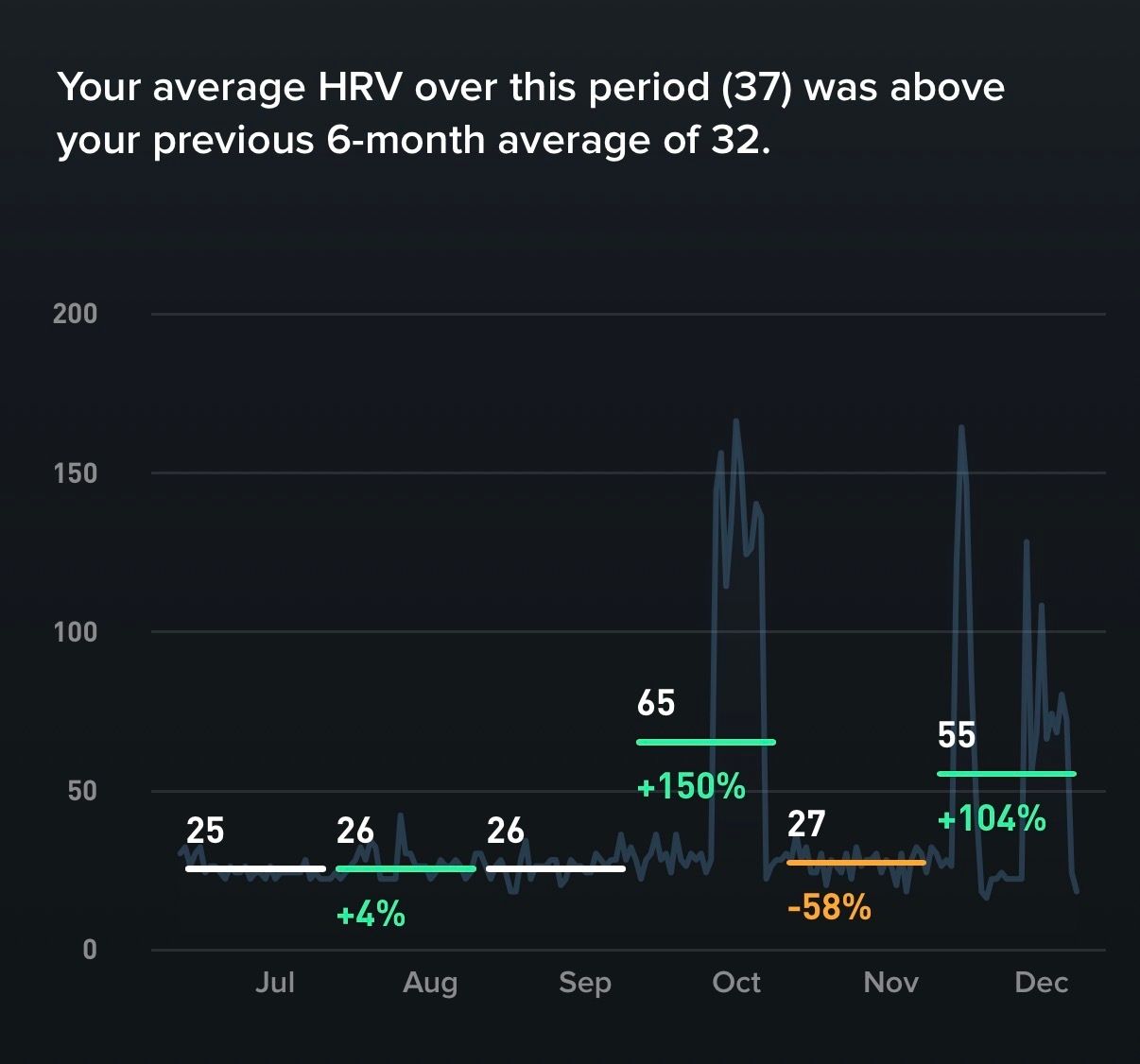

Seriously considering my life as a founder right now. Recently, I had an extraordinary event happen to me after I added really high intensity—zone 4 and 5 for you fitness nerds out there—training to my already stacked schedule of heavy weightlifting.

I woke up one morning with my respiratory rate up 30% (bad), my heart rate up 20% (fine), and my HRV (Heart Rate Variability) up a whopping 800%. It stayed that way for two weeks straight. And throughout the whole thing, my heart felt like it was going to pound itself right out of my chest.

Obviously, I went to the doctor and had ECGs and bloods, which found a “singular ectopic (early) beat captured, but with no heart damage.” The doctor told me non-functional overreaching (the precursor to overtraining syndrome), but that this whole thing could be brought on by stress, which scared the bejeebies out of me. The worst thing is, these periods, although not as prolonged, are becoming more frequent.

As a founder, I always wondered how there was no real ‘physical damage’ from the stress we put ourselves through; well, let’s just say, I wonder no more. Has anyone else ever had anything like this? Send me a reply if so, as I am keen to hear.

Have you ever given yourself physical issues from overtraining or stress? |

Anywho, today’s post is a fun one. It took me a while to write, to be honest, and was something I’d been meaning to do for a while, considering the black box that is Nvidia. Anyway, I hope you enjoy it!

DEEP DIVE 🕵🏻

Jensen Huang - Co-Founder, President & CEO at Nvidia

Jen-Hsun ‘Jensen’ Huang (Chinese: 黃仁勳; pinyin: Huáng Rénxūn; Pe̍h-ōe-jī: N̂g Jîn-hun; born February 17, 1963) is an American businessman, electrical engineer, and the Co-Founder, President, and CEO of Nvidia Corporation. As of February 2024, Huang's net worth was estimated at $162 billion per Bloomberg, making him the 8th richest person in the world.

The incredible thing about Jensen—even rocking his patented leather jacket—is how unassuming he is. The man drives a Toyota Supra. Last year, the Goldman Sachs trading desk called Nvidia “the most important stock in the entire world.”

I am Iron Man.

Today’s story will be one of ambition, tenacity, and survival. I aim to not only demystify, as much for myself as anyone, Jensen and Nvidia, but to show why Jensen should be spoken of alongside both the greats who built our past, and also the small handful in line to build our future. He is the man who is figuratively, and quite literally, holding all the chips.

Early years

Jensen, or Jen-Hsun, was born in February 1963 in Tainan, Taiwan. He and his family moved to Thailand when he was five, before he and his brother were shipped off to live with an uncle in Tacoma, Washington. Jensen was growing up on US soil from the ripe age of nine.

Jensen had a typical, albeit somewhat atypical path through school, graduating two years early at the age of 16. Following high school, he would be on to an electrical engineering degree at Oregon State University, where he would meet his future wife, and mother to their two kids, Lori Mills. She was his original engineering lab partner. |  Huang squad. |

“I tried to impress her—not with my looks, of course, but with my strong capability to complete homework,” Jensen would say of the courting process between he and Lori.

Jensen’s next move would be what all young, smart, technology-obsessed graduates do—a master's degree in electrical engineering at Stanford University, followed by a move into a role at semiconductor company, LSI Logic.

Pre-Nvidia … pre-iN-video-games

While at LSI Logic, Jensen learned how to master the intricacies of custom semiconductor and ASIC technology, honing his skills in large-scale integration and pushing the boundaries of chip design. He also gained experience collaborating with cross-functional teams and understanding the evolving needs of the electronics industry.

His next move was to Advanced Micro Devices, Inc., more commonly known as AMD, where he delved deeper into microprocessor design.

Early Jensen.

AMD was a semiconductor company based in Santa Clara, California, born of Jerry Sanders, and seven of his colleagues from Silicon Valley famed, Fairchild Semiconductor. Recently, Jensen told the Acquired Podcast that he loved his time at AMD, and in an alternate reality, he could see himself still there today.

But as fate would have it, that isn’t the path he chose to take. One evening in late 1992, Jensen would head to grab a quick bite at Denny’s with two engineers from Sun Microsystems. |  |

1993: Jurassic Park, Chicago Bulls & the birth of Nvidia

The year of 1993 was amazing culturally. If you were like me, you likely versticulated (*original word) at the intersection of movies, sports, and video games, then you were in heaven. 1993 was a mecca for jocks and nerds alike.

Michael Jordan and the Chicago Bulls had just completed their first 3-peat, Dr. Alan Grant was on the big screen taking on the T-Rex, and gamers were nonchalantly ripping out spines on Mortal Kombat II. | ❝ Versticulate To use dramatic emotions, inside one’s head, brought on by high levels of excitement. "You could tell that inside, he was versticulating frantically." |

The two Sun engineers that Jensun met with on that fateful evening in 1992 were Chris Malachowsky and Curtis Priem. The three co-founders envisioned that the next wave of computing would be in the realm of accelerated computing, specifically in graphics-based processing. Graphics for computers—and video games. Think Doom & Wolfenstein, but in 3D.

With around $40k in the bank, the team set out to build the next generation of computer gaming. Their first product, the NV1, was successful, but only to a point. It lacked the industry support—mainly from game developers— that it needed to be successful due mainly to the fact that it was optimised for processing quadratic primitives, rather than triangle primitives, which was industry standard.

If you are lacking a PHD in computer science, what I am saying in layman’s terms is, they build something new, and people didn’t like it.

In 1996, with flagging growth and no real prospects on the horizon, Jensen and Nvidia were in a bind. They’d just laid off half of their 100 staff and needed to refocus and get something to market that they knew the industry would actually want. Enter: the RIVA 128. |  Our lord and saviour.  Quake II - on RIVA 128. |

This little chip, and the impact it had on Nvidia, might be the one product that meant today we have the ability to argue with ChatGPT about whether pineapple belongs on pizza.

The RIVA 128, or the Real-time Interactive Video and Animation accelerator, was so popular that it sold a million chips in the first four months of its hitting the shelves.

When Nvidia released the RIVA in August 1997, it was down to its final month of cash flow to fund payroll. It quite literally saved Nvidia from being nothing more than a failed also-ran.

“If you lose my money, I will kill you”

One of the funniest stories from the early stages of Nvidia was related to the late Sequoia Capital founder, Don Valentine. Don was a large, imposing figure in Silicon Valley circles, famous for his no-nonsense approach to investing.

[Venture capital] is all about figuring out which questions are the right questions to ask. And since we don’t have a clue what the right answer is, we’re very interested in the process by which the entrepreneur get to the conclusion. —Don Valentine |  The Don. |

The story of Jensen and Don is that when raising its first round of venture capital, the two legendary figures met for Jensen to pitch the opportunity to invest in Nvidia. Jensen, although usually quite confident, smart and charismatic—totally bombed the pitch.

And Don told him about it. He told him it was terrible. Luckily for Jensen, though, he was introduced by his former employer, LSI Logic's founder Wilf Corrigan. Wilf had spoken incredibly glowingly of Nvidia, and Jensen in particular, so much so that Don knew he was going to invest in him anyway.

As they were finishing their meeting, Don reached out to shake Jensen’s hand and tell him he’d be investing. With the firm grip of a venture capital titan, he looked Jensen square in the eyes and finished with, “If you lose my money, I will kill you.”

Jensen is alive and well today, and Sequoia’s original investment in Nvidia is regarded as one of the great technology investments in history.

The middle years & the rise of the GPU

Riding on the back of the RIVA 128’s success, Nvidia went public on January 22nd, 1999. Later that year, Nvidia would launch a new product: the GeForce 256. This product is the first product marketed as a GPU.

What was so great about the GPU? Well, the GPU was the world's first Graphics Processing Unit (GPU). The GeForce 256 was a big advancement in graphics technology. It integrated both 2D and 3D graphics rendering, with hardware acceleration in a single chip. This had not been done before.

For many of us who have not lived through all the previous technology waves, Nvidia may seem like a somewhat new name on the global stage. But look at this historic revenue run-up of Nvidia’s starting a quarter-century ago.

Year | Revenue |

|---|---|

1999 | $374.5 million |

2000 | $735.3 million |

2001 | $1.37 billion |

2002 | $1.67 billion |

2003 | $1.82 billion |

2004 | $2.38 billion |

Nvidia, by this stage, had begun to make a name for itself in the niche of gaming. And game developers knew that their rabid fanbase would never be happy with the current graphics stack. It could never be more alive. Because of their reputation, Nvidia began working with Microsoft to develop the graphics for the Xbox.

The continued rise of gaming supercharged the company’s growth through the early 2000s. But that wasn’t all Nvidia was suitable for at the time—CAD design systems, automotive infotainment, tablets and smartphones, video processing—all these use cases were built on top of Nvidia’s chips.

But just like all good drama stories, things were about to get a lot darker and stormier for Nvidia. Although Nvidia was the little engine that could of the tech sector, the years 2005 and 2006 saw negative, followed by stagnant revenue growth. The market was becoming increasingly saturated, and they were facing stiff competition, which was pushing down margins and slowing their growth overall.

A brief bright spot was in 2007, when Forbes named Nvidia its ‘Company of the Year,’ highlighting its accomplishments in the early part of the decade. That same year, Nvidia launched CUDA (Compute Unified Device Architecture), a parallel computing platform that marked a significant shift in GPU capabilities. However, unbeknownst to Jensen and his team, the storm clouds of the Global Financial Crisis were gathering, with the trigger being just a few subprime mortgages away.

2008 and CUDA

In the first report of 2008, amid the turmoil of the GFC, Nvidia took a $200 million write-down on its first-quarter revenue. ‘Abnormal failure rates’ apparently the culprit. During this period, from a 2007 high to a 2008 low, Nvidia lost roughly 80% of the value of its stock. For most, if not all, companies, an 80% drop in your stock price is an existential shock to your system.

Courtesy: Seeking Alpha.

Again, Nvidia would need to rebuild, and rebuild itself. They would need to bet the house, again. It’s not something that particularly scared Jensen and the team. During the 90s, they had come up with an unofficial motto that "Our company is thirty days from going out of business." That being said, people were invested. Their careers, their emotions, their finances. So they set out to continue building on their totally new computing platform, CUDA.

CUDA allows developers to write programs that harness the parallel processing power of regular GPUs. |  Huh? |

In machine learning environments, CUDA was a game-changer as well. ML is all about crunching massive datasets. A heavy lift, computationally speaking. But with CUDA, devs can train and run models way quicker than with just CPUs. This boost has led to some mind-blowing breakthroughs, from recognising images and speech to processing natural language and beyond.

CUDA was thought of as the best-in-class software for many of its use cases. And Jensen knew it. This was one of the times in which he would pull one of the great levers in business. When you know you have a significant technological advantage, raise your prices.

There could be nothing that could be faster. We also chose a cost point substantially higher than any of our competitors would be willing to go.

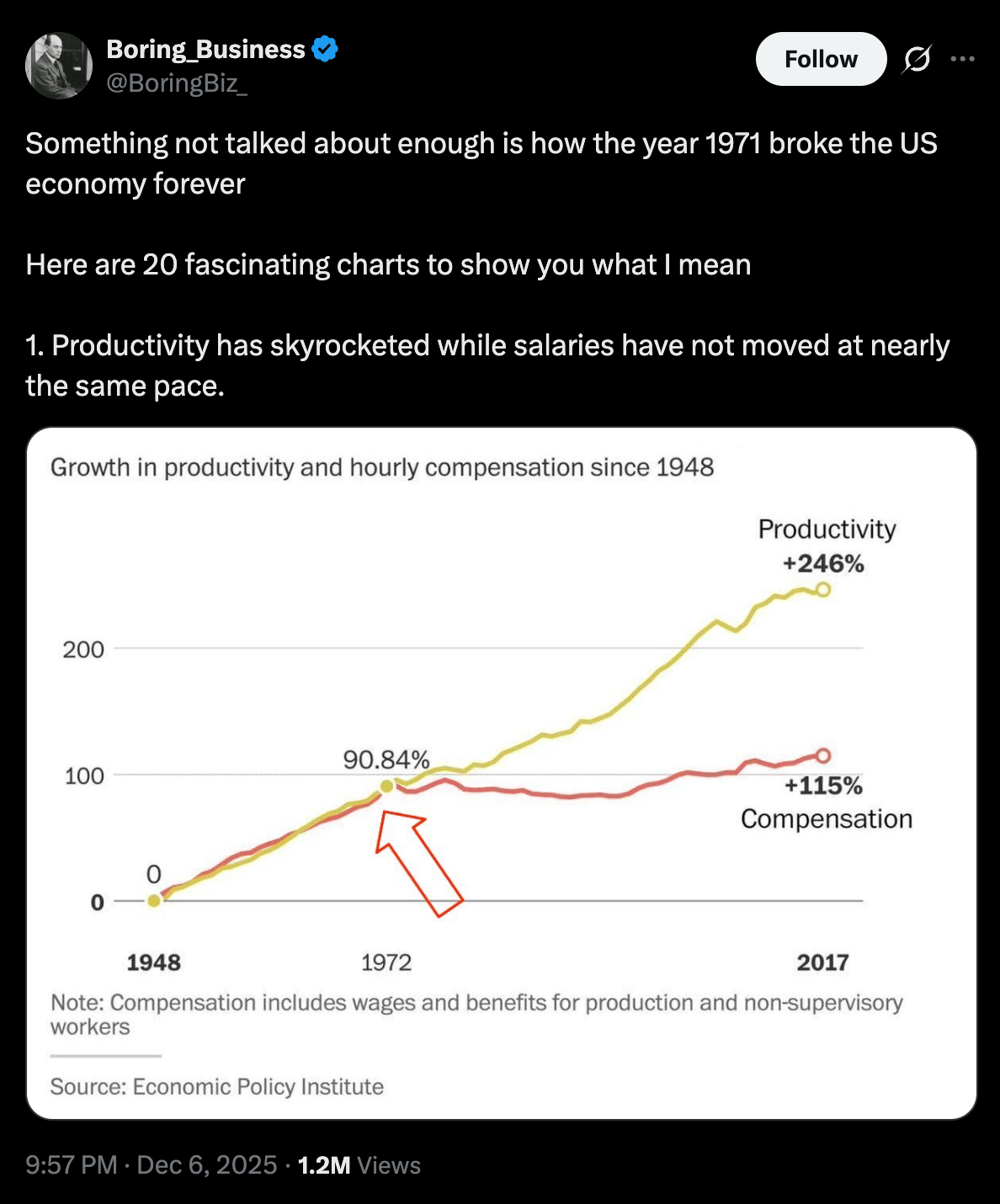

This is a muscle Nvidia and Jensen have been building over time, and flashing forward to today for a moment, Nvidia’s current gross margins are in the mid 70s, up from 66% only two years ago.

30-year overnight success

There are a lot of things that happened in the years in and around the crash of 2008. Competitor AMD would approach Jensen for a potential merger. Nvidia stock would plummet 50%+ (again) after a bad stock call. And deep learning would be supercharged with AlexNet, the brainchild of Alex Krizhevsky, Geoffrey Hinton, and Ilya Sutskever of OpenAI.

But all the way through, Nvidia would keep moving forward. Their rise seems to me like the inverse of Hemingway’s famous line about bankruptcy. |  Do you even Nvidia? |

Smart Silicon Valley insiders saw it coming, though. Marc Andreessen in 2016 noticed that everyone was building on Nvidia and was quoted as saying; “if we were a hedge fund we’d put 100% of money into Nvidia.” And NVIDIA's slow but strategic shift towards AI, deep learning, and data center markets puts it front row centre to capture the value of the next wave of computing.

Accelerated computing, at data center scale, and combined with machine learning, has sped up computing by a million-x.

But even with the strong tailwinds towards the end of the 2010s, no one in their right mind could predict what would come to pass in the latter part of 2022.

The great battle for chips

Every so often, there is a hype cycle in technology that blows the doors off the industry. You can go as far back as the Space Race, through the rise of the personal computer, the internet, and the Dot-Com boom. More recently, we have seen social media, mobile, blockchain & (lol) web3.

But there may be no bigger hype cycle—and no more meaningful one—than the cycle we are going through today. The hype cycle that is artificial intelligence.

On November 30, 2022, Sam Altman and the team at OpenAI dropped a product release so popular and so revolutionary that it surprised even their staunchest believers. ChatGPT. The trajectory of Nvidia, and the world for that matter, would be changed forever.

It was as if the man with the starter's gun pulled the trigger, and the race was on. Not only a race between big tech—Google, Amazon, Meta, and Microsoft—but a race against regulators, a race against China, and really a race against time to build enough energy to power the data centers of the world that are powering this AI revolution.

One thing we do know is that the market believes the story of Nvidia. “I’ve never seen anything like this,” Scott Galloway would say of their rise. Before we take a final look at the future for Nvidia, let’s look at a few things that make it unique.

Rule #1: Bet the farm, just don’t die doing it

One thing that Nvidia has done really, really well since its founding in 1993 is what one could only describe as not dying. Somehow, through Jensen’s phenomenal leadership, they have managed to make bold, courageous bets and have them miraculously pay off.

Nvidia: Life, (not) death, and taxes.

And although it may look lucky—and let’s be clear, there is a healthy amount of luck involved in any successful business tale—their success is also by design. Jensen is famous for talking about making sure Nvidia is, in fact, in the right place at the right time. Or close enough to be able to have impacts. He calls this the “zero-billion-dollar market”.

We prefer to position ourselves in a way that serves a need that usually hasn't emerged. We call that a zero-billion-dollar market. It's our way of saying there's no market yet, but we believe there will be one.

In order to position yourself in this way, you need to be spending time on things that may not look important at the time. And you may need to push all your cards in. Take NVIDIA’s vision in ~2010 to create “neural network processors, safety architectures that run AI algorithms”.

This was at a time would have been close to a ‘zero billion dollar market.’

💡 Note: If you are looking to hire engineers experienced in AI, machine learning, and other bespoke stacks, Athyna can help you find them.

On management & leadership

Jensen has a unique perspective when it comes to management. And prefers to think from first principles when it comes to organisational design. Nvidia has a famously flat structure, unlike most companies you would see today.

Information doesn’t have to flow from the top to the bottom of an organization, as it did back in the Neanderthal days when we didn’t have email and texts and all those things. Information can flow a lot more quickly today. So a hierarchical tree, with information being interpreted from the top down to the bottom, is unnecessary. A flat network allows us to adapt a lot more quickly, which we need because our technology is moving so quickly.

Now, when I say a flat structure, I mean very flat. Jensen personally manages ~40 direct reports today. His reports submit a weekly list of the five most important things they are working on, of which Jensen reviews every morning. He elaborates further:

If you look at the way Nvidia’s technology has moved, classically there was Moore’s law doubling every couple of years. Well, in the course of the last 10 years, we’ve advanced AI by about a million times. That’s many, many times Moore’s law. If you’re living in an exponential world, you don’t want information to be propagated from the top down one layer at a time.

When talking about the typical org structure you see today—think C-level, VP, Head of this, Director of that—he was particularly critical, preferring a ‘horses-for-courses’ approach to organisational design.

What is this machine that you are trying to create? What is its output, what is its input, what are the conditions that it is in? What is the industry like? Is it a fast-moving industry? Is it bureaucratic? Is it highly regulated? What kind of industry is it? And what are you trying to build?

I could go on. There are no departments, no business units, no status reports. They do not have a 1-year plan, 3-year plan, god forbid, a 5-year plan. Jensen has a very particular way of running his org, and hey, maybe we are the weird ones.

Playbook

Anticipating market trends: Jensen foresaw the significance of GPUs not just in gaming but in a wide range of computing tasks, including artificial intelligence. His ability to anticipate and invest in these trends early on has kept NVIDIA at the forefront of innovation.

Technical expertise: With a foundation in electrical engineering, Jensen has a deep understanding of the technical aspects of NVIDIA's products. This understanding allows him to make good decisions day-to-day and drive the right changes within the company.

Embracing adversity: Jensen co-founded Nvidia with a bold vision, despite the risks associated with starting a new company in the competitive semiconductor industry. His willingness to take calculated risks along the way meant they could push the envelope of new technology.

Banesun Huang.

Cultivate partnerships and community: Jensen recognised early on the importance of developers as partners in innovation. He has actively fostered an open-source developer ecosystem and has invested heavily in developer relations. He has also excelled at forging partnerships across industries, from automotive to science to healthcare.

Prioritise long-term innovation: Jensen pushes relentless research and development, investing heavily in future-oriented technologies even when they don't offer immediate returns. “We spend about a decade in $0B dollar markets,” he said.

Have a bit of luck on your side: And be lucky. No one really saw this AI boom—at least to this extent. Sometimes you just have to carry a rabbit’s foot around in your pocket and hope for the best.

Future

Today, so much of what we touch is powered by Nvidia. Your favourite social feeds, the algorithm you use while scrolling YouTube, and even your car if you happen to drive a Tesla. And while the rise of Nvidia has been a 30-year success story, in Jensen’s eyes, they are just getting started.

We’re building a new type of data center. We call it an AI factory. The way data centers are built today, you have a lot of people sharing one cluster of computers and putting their files in this one large data center. An AI factory is much more like a power generator. It’s quite unique. We’ve been building it over the last several years, but now we have to turn this into a product.

It seems the battle for AI supremacy is well underway, and Nvidia is more driven than ever to be at the forefront, leading us into the future. |  |

In the history of technology, there has been one guiding principle regarding the pace of computing growth: Moore’s Law. But like all true rebels, Jensen sees this law as nothing more than an antiquated relic of less ambitious times.

We looked at the way Moore’s law was formulated, and we said, ‘Don’t be limited by that. Moore’s law is not a limiter to computing.’

It's the year 2025, folks. AI is here. The future has arrived. And if Jensen Huang has anything to do with it, we're only just getting started.

Fun factoids

Naming the company: The name ‘NVIDIA’ is derived from combining .nv for ‘next version’, the word ‘Invidia,’ which is Latin for envy. The brand is green because, well, green with envy.

Biggest fear: Jensen said recently that his biggest fear is the same today is was on the first day of Nvidia; “letting his employees down”.

There would be no do-over: If he had the chance to do it all again, what would he do differently? His answer: he would simply not do it at all.

Tattoo appreciation: Huang is a fan of tattoos; he’s not afraid to show off his guns and flex some bicep art from time to time.

Car aficionado: Huang has a well-documented love for fast cars. He owns several high-performance vehicles, including a Ferrari 599, a Ferrari 430, and a Swedish Koenigsegg CCX.

Extra reading

The Acquired Podcast Series + Jensen Interview - Over the last 5 years

Stratechery interview: Manufacturing Intelligence - March, 2022

Stratechery interview: AI’s iPhone Moment - March, 2023

Nvidia Hardware Is Eating the World; Wired - February, 2024

Microsoft, OpenAI & Nvidia Back $2.6B Robot Startup - February, 2024

And that’s it! You can also hope you enjoyed it, folks. You can go out and build your own AI startup on Nvidia’s chips here, haha.

Are you interested in learning more about Attio? |

BRAIN FOOD 🧠

TOOLS WE RECOMMEND 🛠️

Every week, we highlight tools we like and those we actually use inside our business and give them an honest review. Today, we are highlighting Framer*—the site builder trusted by startups to Fortune 500.

See the full set of tools we use inside of Athyna & Open Source CEO here.

HOW I CAN HELP 🥳

P.S. Want to work together?

Hiring global talent: If you’re hiring tech, business or ops talent and want to do it 80% less, check out my startup, Athyna. 🌏

See my tech stack: Find our suite of tools & resources for both this newsletter and Athyna here. 🧰

Reach an audience of tech leaders: Advertise with us if you want to get in front of founders, investors and leaders in tech. 👀

|

Reply