- Open Source CEO by Bill Kerr

- Posts

- Brand Breakdown: Does Liquid Death’s Brand Convert?

Brand Breakdown: Does Liquid Death’s Brand Convert?

It's rock and roll water, but it doesn't it work for everyone, and that's ok. 🎸

👋 Howdy to the 1,972 new legends who joined this week! You are now part of a 156,798 strong tribe outperforming the competition together.

LATEST POSTS 📚

If you’re new, not yet a subscriber, or just plain missed it, here are some of our recent editions.

🧠 Helping Discover Reliable Information Online, With AI. An interview with Luke Kim, Founder & CEO at Liner.

🪨 Fixing Marketing's Missing Middle. A detailed guide on how to better perform through the forgotten arm of your marketing.

🗞️ Launching & Scaling A New Media Giant. An interview with Tim Huelskamp, Co-Founder & CEO at 1440.

PARTNERS 💫

Delve just raised a $32M Series A at a $300M, led by Insight Partners!

We’re reshaping compliance with AI that eliminates busywork and gets startups like Lovable, Bland, and Browser compliant in just 15 hours. To celebrate, we’re offering:

$15K for referring a founding engineer

$2K off for new customers

A custom Delve doormat if you repost + comment on our LinkedIn

Thanks for your support—this is just the beginning.

Interested in sponsoring these emails? See our partnership options here.

HOUSEKEEPING 📨

Really not much to say in the housekeeping today. I am exhausted. This week I tried to mix a bit of CrossFit in with my weightlifting to sweat a bit more, and it smashed me. Weightlifting is incredibly taxing on your central nervous system because you more or less squat and deadlift (actually ‘clean pull,’ but might as well be a deadlift) every day. This means you need to rest, recover, eat and sleep, a lot.

No political flags and no lectures.

— Rael Braverman (@raelbrav)

7:11 AM • Jul 13, 2025

Usually, when it comes to cardio, I try to go very easy: rowing, bike, aerodyne or whatever it’s called. That way, I am not taxing my CNS as heavily as, say, a CrossFit WOD. I have also been trying to sauna 3-4x per week. And for some reason, I am just dead. It’s kinda hard trying to be a founder, write this newsletter, and train really hard in a strength sport at 39 years young. Anyway, I am happy that I am training. It’s better than the alternative. Enjoy today’s post!

GUEST POST 💄

Brand Breakdown: Does Liquid Death’s Brand Convert?

H2O, street name: water. You may have heard of it. Dinosaurs drank it. Fish swim in it. Jesus walked on it. It’s all around us. Heck, the human body is 60% water. You could say, it literally is us. In the words of the great, 3 x Male Model of the Year winner Derek Zoolander, "Moisture is the essence of wetness and wetness is the essence of beauty.”

Water is also boring. It has zero flavour, throwing it in someone’s face rarely injures them, and you can actually see right through the damn thing. To such an extent that in some cases, it’s even hard to prove its existence. But I am not here to bloviate (/ˈbləʊvɪeɪt/) on the boringness of water. I am here to talk about a different type of water. A rock album in a can. The kind of water Hunter S. Thompson would snort up his nose after a long night behind the typewriter. I am talking about Liquid Death.

It takes some real brand and creative wizardry to transform something as dull as water and turn it into a brand celebrated across the globe. Magic Spoon did it with cereal. I bank with the Aussie neobank, Up, which did it with banking. And my buddy Simon did it at Who Gives A Crap (yes, it’s toilet paper). However, today’s piece is not about whether you can build a brand around water, but more so, whether said brand actually converts?

The good news is, I have a crack team of investigators ready to dive into this rock and roll water phenomenon. Today, we’ll be joined by brand tracking mega-minds Jean Teng and Elly Strang from one of the fastest-growing startups you’ll see, Tracksuit. They’ll help us make sense of this whole dammed situation. Over to you, ladies!

An introduction to a very loud water brand

You can’t escape Liquid Death. As a challenger brand making waves with flashy moves, it’s proven irresistible catnip for big marketing brains.

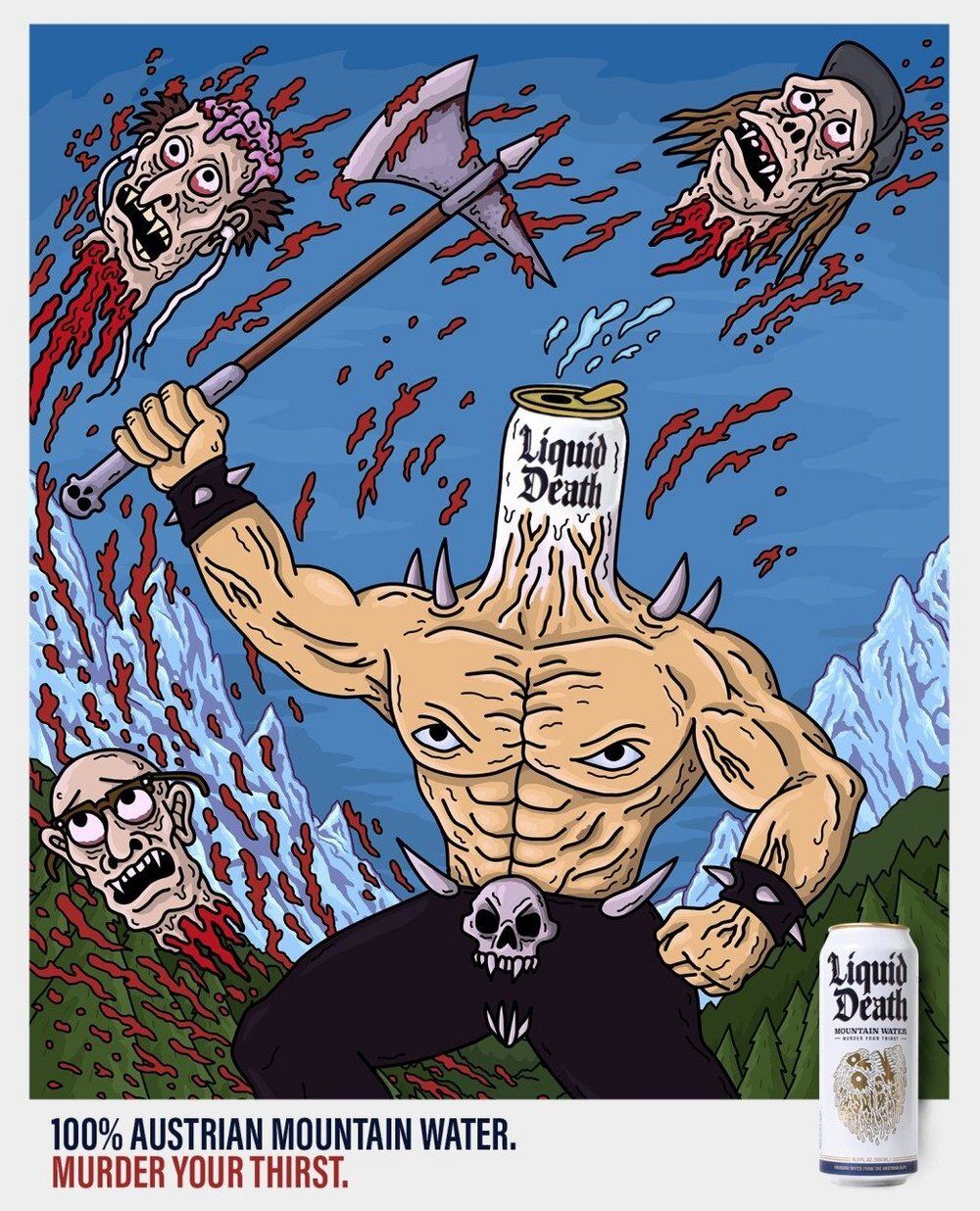

The irreverently branded canned water company, which only launched in 2019, has set out to disrupt the industry with its skull-heavy branding that would make anyone expect their first swig to be beer—or perhaps a yellow Monster Energyesque liquid—and not water.

You’ve probably seen it on TikTok (7M followers). And Instagram (7.5M followers). And likely LinkedIn (153K+ followers) too. And you see it in the hands of social media influencers and celebrities like Tony Hawk and Martha Stewart. The company is now valued at an impressive $1.4 billion dollars.

“We think about our marketing team more like Saturday Night Live,” Mike Cessario, the Founder of Liquid Death, has said. “We’re making fun of the shit corporate marketing that everyone hates.”

The tongue-in-cheek tone Liquid Death strives for is captured expertly in its 2022 Super Bowl ad, featuring a bunch of kids wilding out at a birthday party, chugging on cans of Liquid Death—a direct jab at the usual gathering of drunk dudes at a Super Bowl watch party. It’s simple, funny, effective and attention-grabbing, very positive attributes when all you’re really selling is water.

|  |

Since then, Liquid Death has been nailing the social media game, creating silly and engaging content to appeal to unimpressed digital natives. Take their beefing up your hydration game, which features a can being wrapped in a cosy of raw minced meat, or a collaboration with satirical television show, The Boys, where one of the characters, The Deep, is relating Liquid Death’s sustainability ethos with his own love of marine life.

They also know how to go to where their customers are, partnering with music festivals like Download and LiveNation. They love collaborating with other cool brands like Dr Squatch (see: Soap for Psychos); e.l.f Beauty (see: Corpse Paint) and even Depends (see: Pit Diaper).

Source: Liquid Death (buy yours today).

So, they’ve done something we know isn’t easy: fostering emotional attachments to canned water. But how is this translating to the real world?

How Liquid Death are growing awareness

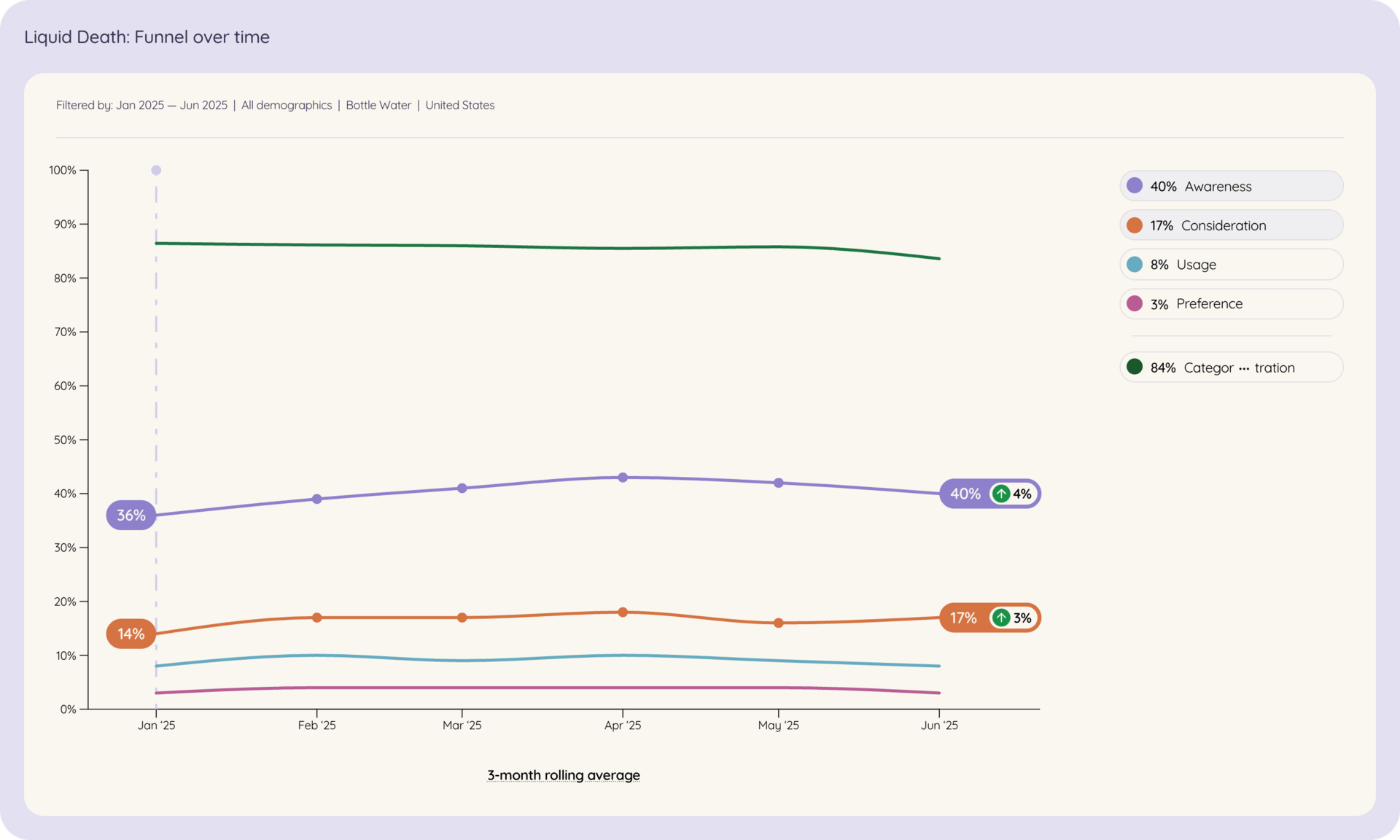

In the US, Liquid Death’s personality-first approach is working hard to increase awareness. Liquid Death has grown its awareness from 36% to 40% in the last six months in the US, from Jan ‘25 to June ‘25 (4% increase). If we’re talking numbers, that means ~85.1 million people now know what Liquid Death is—an additional 5.3 million more than in the six months before. For even more context: the brand has increased its awareness base from 46.7M people to 85.1M people in the last two years (June ‘23 to June ‘25).

Liquid Death also knows precisely how to play to their target consumer base, with awareness amongst the 18 to 24 and 25 to 34-year-old age groups a considerably higher 56%.

This big uptick in awareness has also translated into growth in other parts of their marketing funnel, too. Consideration increased 3% in the last six months, meaning ~35 million people consider drinking it. It is now the preferred water brand of the ~6.7 million Americans who drink bottled water (3%).

*Although we must note that Liquid Death’s Preference metric hasn’t meaningfully shifted in the last year.

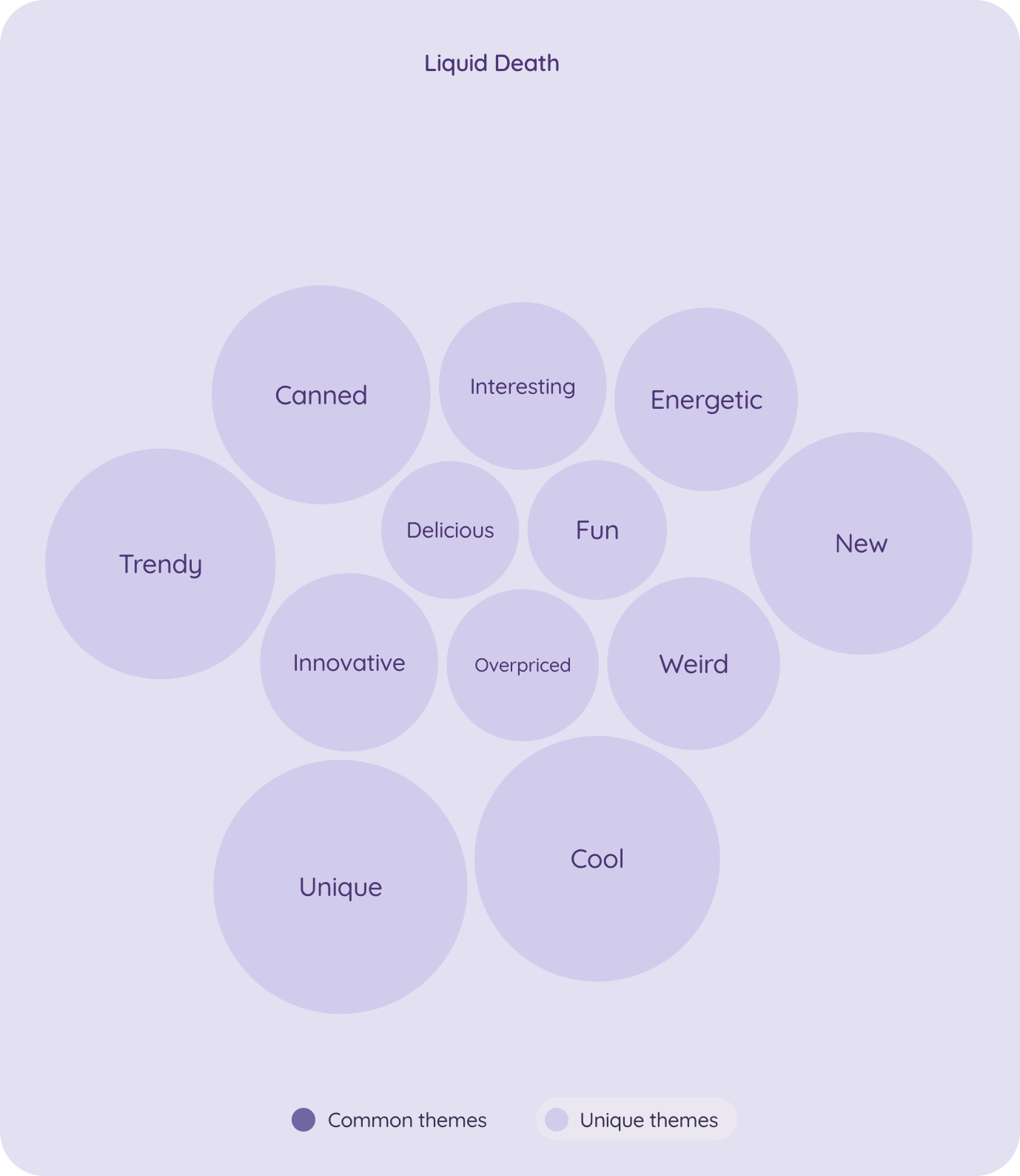

And, perhaps most importantly, the attention they’ve paid to building their brand has made people have pretty strong feelings about it (hence ‘emotional connection’), despite the product being just water, with many describing it as cool, unique, trendy and even weird; in this case, good weird. People have even told Tracksuit they think Liquid Death has a ‘heavy metal swagger.’ Not surprisingly, there are fewer words associated with the product itself. |

Brand love ≠ brand growth (sometimes)

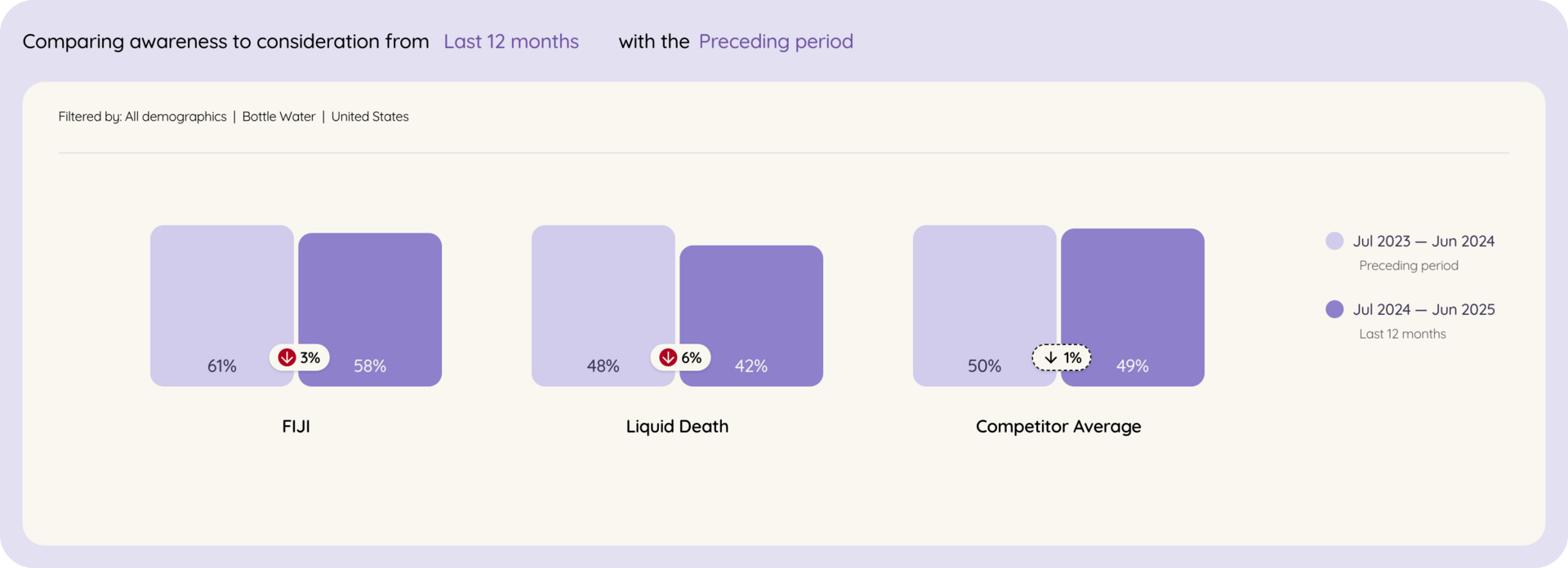

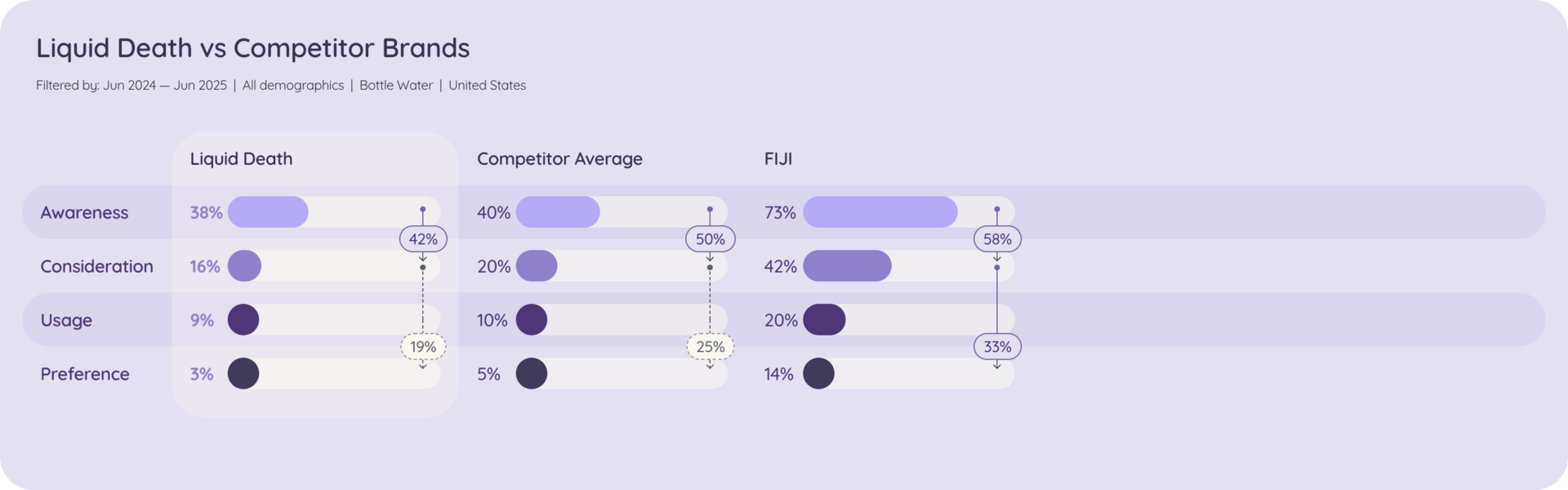

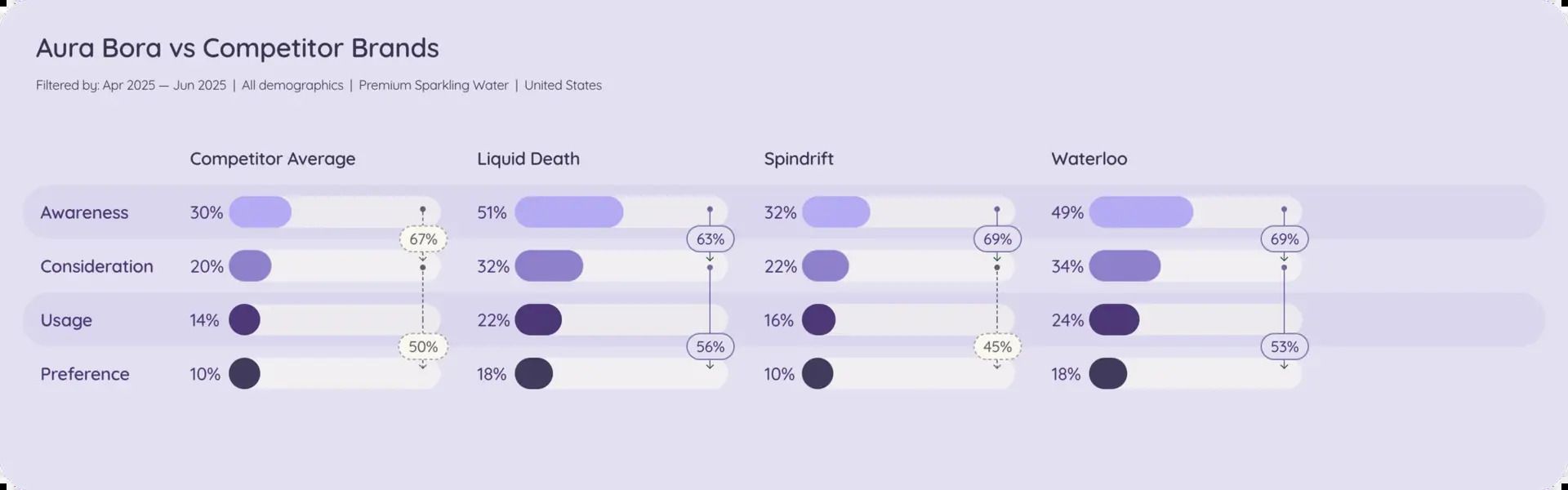

Suppose we’re really drilling down into the detail, though. In that case, you’ll find that Liquid Death’s top of funnel conversion—that is, converting people from merely being aware of it to actually considering drinking it—from Jul ‘24 to June ‘25 is 42%, below the competitor average number of 50% and much below the market leader, FIJI water, where 58% of people move down from awareness to consideration. It’s a similar story with the bottom of funnel conversion (from consideration to preference). At 19%, this metric is below the competitor average of 25%.

Additionally, Liquid Death’s awareness-to-conversion rate has decreased significantly over the last two years, dropping from 48% to 42% when comparing the last 12 months to the preceding 12 months.

We could interpret this as a reflection of its lack of emphasis on the product itself. The audience might know the brand, but that doesn’t always mean they drink the canned water Kool-Aid.

By viewing the brand as an ‘entertainment machine,’ Liquid Death risks losing sight of the importance of its product and becoming a passing fad. People generally talk about the ads, not about the clean water from the Alps, or the environmental benefits of being in aluminium cans vs plastic—case in point: this article.

Our data also shows that while people aware of the brand think Liquid Death is innovative, there are a couple of worrying eyebrow raises.

For example, it rates lower than all other water brands on the statement ‘is a brand I trust’ (16% compared to FIJI’s 37%), and is middle of the pack with ‘is sustainable’ (a concern considering one of Liquid Death’s main differentiations on its product is the sustainability of being canned). It also rates low on ‘is for people like me’ (17%)—meaning the brand could be alienating a good chunk of its potential customer base.

Mark Ritson talked about Liquid Death in Marketing Week, describing the brand as: “The perfect pin-up for a generation of marketers who define marketing as advertising and who spend their careers ignoring the remaining 90% of our discipline’s hinterland.”

In the column, he argues the need to direct more attention to making the product as good as possible, instead of purely on the flashiness of promotion. In it, he makes the prediction that Liquid Death will “not grow into a behemoth.”

This goes back to the classic theory of the original 4Ps—product, price, place, and promotion—which are elements of a marketing mix that provide the framework for an effective strategy. In an ideal world, you’d give equal attention to each P, which doesn’t seem to be the case at Liquid Death, which is investing the most time and effort into promotion. Big red flag here.

The cult of Liquid Death

Our take on the bottled water category, where the data in this post on Liquid Death came from, is that when people want water, they just want a run-of-the-mill bottle, sans a side of heavy-metal branding. It’s when people are thinking about a premium sparkling water they may splurge on, when consumers are choosing what to drink in a social setting—perhaps instead of alcohol or a less healthy energy drink—Liquid Death becomes top of mind.

When compared to premium sparkling water brands like Waterloo and Spindrift, Liquid Death enjoys higher awareness, consideration, usage and preference, and much better conversion down the funnel compared to in the bottled water category.

This makes sense considering Liquid Death’s USP is its brand. Holding a can of LD is a status symbol that could feel a bit cooler than FIJI (and more in line with a can of alcohol that other people are drinking at the concert you’re attending). It’s in these social settings that the Liquid Death price point becomes less of a barrier, as it essentially acts as a Fancy Drink, not water.

Other brands running this playbook well

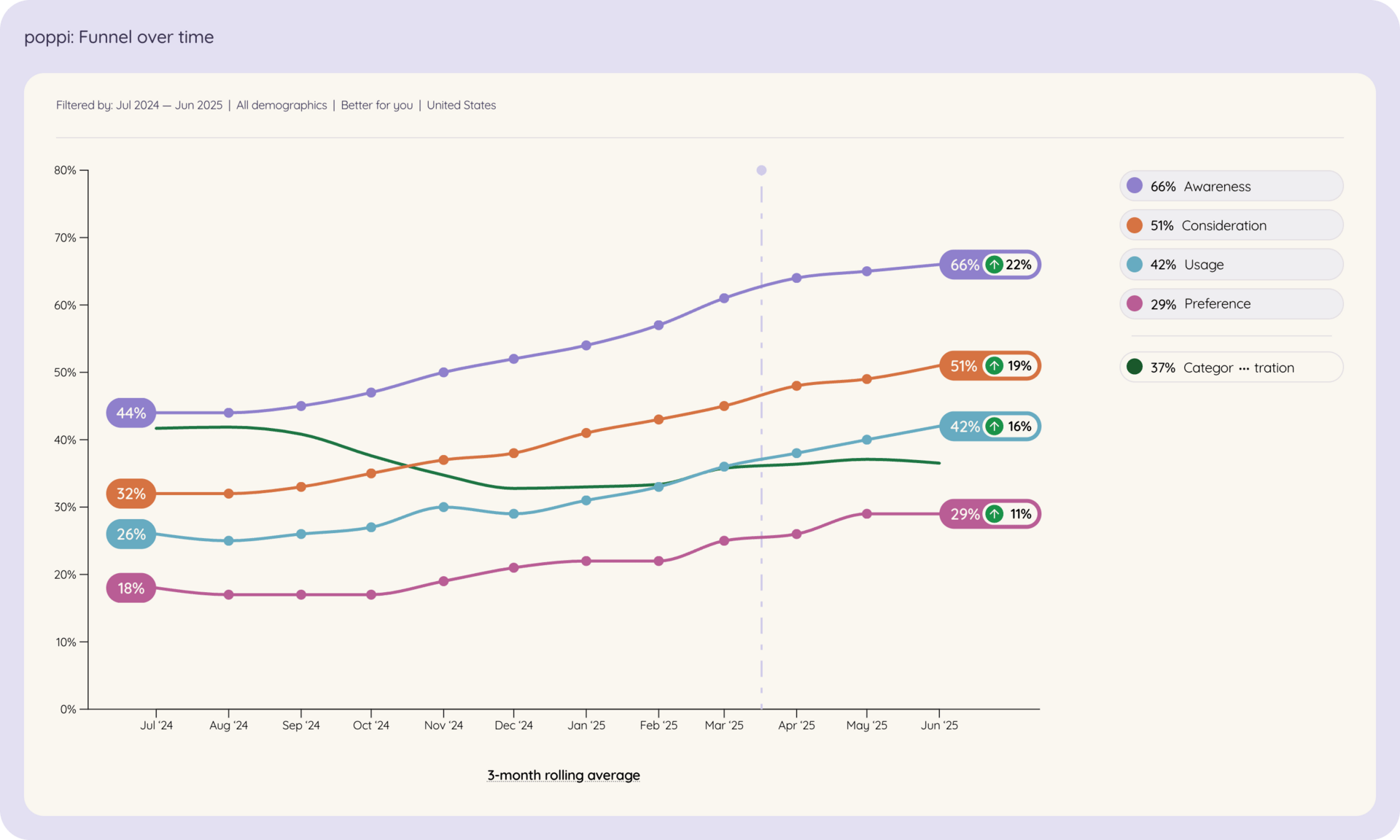

poppi is a prebiotic soda that was founded in 2015, with a similar target audience. That is, Gen Zs and millennials, and the social media marketing strategy that comes with that territory, though it’s more Paris Hilton to Liquid Death’s Ozzy Osbourne. Like Liquid Death, they’re disruptors, with poppi pivoting the image of soda from sugar-laden treat food to a more healthy alternative, better-for-you sodas. Plus, they just sold to PepsiCo for $1.95 billion.

In the last couple of years, poppi has leaned right into influencer partnerships—even taking a leaf out of the Tracksuit book and teaming up with TikTok star Alix Earle, gifting her branded sweats to wear during Coachella—and playful humour (their Super Bowl spot became the most watched commercial in 2024). Sound familiar?

As a result, poppi has made huge strides in the last six months, increasing in awareness from 44% to 66% from July ‘24 to June ‘25. That’s ~15M more people who are aware of their brand. To put that into perspective: just one year ago, poppi’s brand awareness was only 27%. They’ve also experienced massive increases all across the board.

We also see this entertainment-first, community-building strategy work with other non-drink category brands, like Duolingo and Rhode. Everyone knows the Duolingo story, and you can see it pay off in their funnel. From July ‘24 to June ‘25, the chaotic marketing playbook they’ve carefully crafted (including the mascot’s most recent death) resulted in a 5% increase in Awareness and 3% shift in consideration.

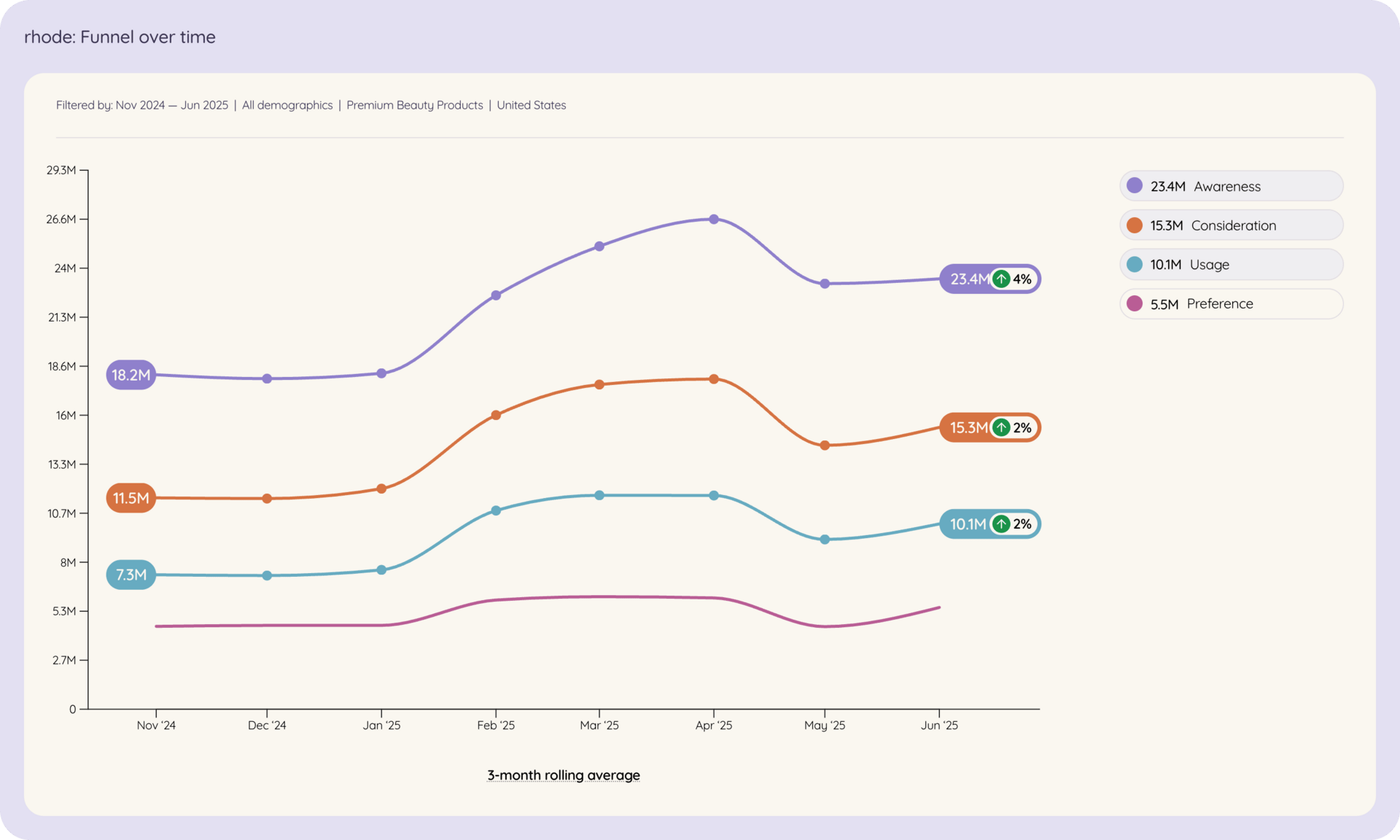

Rhode is a bit of a different story. Perhaps not as brash and bold as Liquid Death or Duolingo, its community-building focus made it stand out in the crowded skincare category, with a goal to drive a cult-like fandom of followers. Since launching in 2022, the team created an immersive world that recalls a certain aspirational lifestyle: all beaches, cocktails, fashion runways, glazed donuts and slick, clean-girl aesthetic, as well as investing heavily in influencers and celebrities.

Again, we can see this hard work reflected in our brand health metrics, with awareness, consideration and usage all increasing from Nov ‘24 to June ‘25. Awareness, for example, rose by 4%; in human terms, that’s 18.2 million people to 23.4 million people.

It’s always more impactful when you translate those percentages into what that means in real life. Additionally, this all translates directly to the bottom line, with Rhode selling to e.l.f Beauty in an acquisition worth $1B. Not bad.

Playbook / how you can apply this

Start with a sharp brand concept: Create a brand that stands for something specific, with a clear voice and consistent creative direction.

Build distinctiveness into every touchpoint: From packaging to social posts, ensure your look, tone, and style are recognisably yours, instantly.

Earn attention organically: Develop marketing that people want to share, not skip. Think in campaigns, characters, and cultural hooks.

Meet your audience where they are: Prioritise the channels where your customers already spend time. Don’t wait for them to come to you.

Track awareness and conversion: Use funnel data to understand what’s working, not just on brand sentiment, but consideration and preference too.

Balance hype with credibility: Ensure your product experience lives up to the brand. Messaging should reinforce trust, not just spark curiosity.

Adapt fast, but don’t drift off-brand: Experiment, iterate and play, but stay anchored in your brand’s core identity as you scale.

Future

Following its last funding round in 2024, Liquid Death has undergone a series of changes, expanding its product lines and refocusing its efforts on target markets. We’ve seen the brand drop new soda ranges—“You won’t believe it’s soda” for example—featuring its own take on Coke. It has also recently announced a move into a space that should feel natural for them, considering its branding has been much compared to the category: energy drinks. The upcoming ‘Sparkling Energy’ will begin releasing energy drinks from next year, offering a caffeine boost of less than the industry standard of 200mg.

Its sales were up in 2024—up 63% the year prior—but the brand wasn’t able to resonate in all markets. It left the UK market in early 2025, less than two years after it launched, with some saying that it wasn’t a failure of brand, but a failure of logistics (shipping costs, among other factors). Right now, Liquid Death is looking for a new injection of cash, and with the energy drinks launch on the horizon, it’s safe to say that this brand is determined to endure and become one of the greats of this century.

Fun facts

From joke to juggernaut: Founder Mike Cessario mocked up a fake ad for canned water to parody energy drinks. It went viral before the product even existed.

They once sold a $1,200 severed hand candle: Yes, you read that correctly. And they collaborated with Martha Stewart on the entire project.

They’ve raised over $200 million: With investors like Tony Hawk, Live Nation, and Mark Rober, Liquid Death is now valued at over $700 million.

They sponsor punk bands, priests on skateboards, and chaos itself: Their athlete and creator roster includes pro wrestlers, tattooed stuntmen, death metal comedians, and more.

Extra reading / learning

Blue Ribbon, MJ & The Swoosh: The Story Of Phil Knight - June, 2024

El Ascenso De Duolingo (The Rise Of Duolingo) - October 24, 2024

Neumannomics: A Deep Dive - January 30, 2025

Nike’s Fall From Grace & Super Bowl Comeback - April, 2025

And that's it! You can connect on LinkedIn with Jean and Elly, and also don’t forget to check out Tracksuit while you’re at it.

BRAIN FOOD 🧠

TWEETS OF THE WEEK 🐣

YouTube now owns 12.5% of all U.S. TV viewing time - more than any other distributor.

1B+ hours are watched daily on YouTube, surpassing Disney across broadcast, cable, and streaming.

No studios. No soundstages. No scripts.

Just total living room dominance.

$GOOGL

— Charlie Bilello (@charliebilello)

1:33 PM • Jul 21, 2025

Still the best business book

— Ryan Petersen (@typesfast)

1:32 PM • Jul 25, 2025

Nvidia CEO Jensen Huang just made the boldest prediction of his career:

“AI will create more millionaires in 5 years than the internet did in 20.”

But he didn’t stop there.

He revealed exactly HOW it’ll happen

Here’s his framework for capitalizing before it’s too late: ⬇️

— Heath Ahrens (@heathahrens)

3:30 PM • Jul 24, 2025

TOOLS WE USE 🛠️

Every week we highlight tools we actually use inside of our business and give them an honest review. Today we are highlighting Paddle—a merchant of record, managing payments, tax and compliance needs—we use their ProfitWell tool.

See the full set of tools we use inside of Athyna & Open Source CEO here.

HOW I CAN HELP 🥳

P.S. Want to work together?

Hiring global talent: If you’re hiring tech, business or ops talent and want to do it 80% less, check out my startup Athyna. 🌏

Want to see my tech stack: See our suite of tools & resources for both this newsletter and Athyna here. 🧰

Reach an audience of tech leaders: Advertise with us if you want to get in front of founders, investors and leaders in tech. 👀

|

Reply