- Open Source CEO by Bill Kerr

- Posts

- Tracksuit’s Bootstrap To Series B

Tracksuit’s Bootstrap To Series B

A company that is growing really, really, really fast. 💨

👋 Howdy to the 2,385 new legends who joined this week! You are now part of a 257,104 strong tribe outperforming the competition together.

LATEST POSTS 📚

If you’re new, not yet a subscriber, or just plain missed it, here are some of our recent editions.

🗣️ Unfiltered: Hyperbound From The Inside. The conversations that shaped the company.

🍿 Inboxed: Tech Partnership, Tech Poaching. A behind-the-scenes look at the technology hiring wars.

⚙️ Why AI Is Easy To Demo And Hard To Trust. An interview with Hamel Husain, Founder at Parlance Labs.

PARTNERS 💫

Framer is the design-first, no-code website builder that lets anyone ship a production-ready site in minutes. Whether you're starting with a template or a blank canvas, Framer gives you total creative control with no coding required.

Add animations, localise with one click, and collaborate in real-time with your whole team. You can even A/B test and track clicks with built-in analytics.

️Turn LinkedIn into your #1 client acquisition system. Playbookz helps CEOs and execs generate steady conversations and meetings on LinkedIn, without writing posts or managing DMs.

System is: founder-led content from a monthly call, paid amplification, message ads, and a setter who turns DMs into booked meetings. Most teams see ~50k monthly reach and 10+ meetings.

Readers get $1k off their first month.

Interested in sponsoring these emails? See our partnership options here.

HOUSEKEEPING 📨

During our 2026 predictions write-up, I considered including a prediction that Anthropic would overtake OpenAI as the preferred LLM by year-end, but shelved it because it was too close to last year's prediction. Well, I am adding it as a late prediction. Aside from general knowledge, small talk, and my Spanish tuition in voice mode, I use ChatGPT for exactly zero important work these days. It is true that I still run a lot of prompts through both Claude and ChatGPT, but I rarely, if ever, use the latter’s output, and I am starting to stop comparing altogether.

Given the stark differences in how they approach profitability, compute, and burn, I’m not sure OpenAI will exist in 24 months. I am certain Anthropic is building the next Microsoft. Sam Altman and the team have done an amazing job creating the AI rush we are experiencing, but I’m wondering whether they are building the next Microsoft acquisition. Anyway, enjoy today’s writing. I love this one!

ZERO TO ONE 🌱

Tracksuit’s Bootstrap To Series B

Apple, Nike, Google, Rolex, Netflix, Labubu, House Stark. What do these world-renowned brands have in common? Love: check. Trust: got it. Authority: damn right. But have you ever stopped to consider why, when you want to turn on the television, you refer to it as ‘putting on Netflix,’ or when doing a search, you ‘Google it?’

The truth is, these associations don’t happen by accident, and they don’t happen overnight. These brands have spent years, decades, or, in the case of House Stark, millennia investing in their brand. They have provided value to their world, building their foundation brick by brick over time. But they haven’t just built great products; they have also invested in their brand through storytelling. They know how, as Simon Sinek would suggest, to embed themselves in the limbic brain of their host, until they are overtaking any and every other associated brand. Apple is the long-reigning champion of this.

Until a few of their recent fumbles, people have proudly called themselves ‘Apple people.’ They have been able to do this with their huge budgets and behavioral scientists. For the longest time, it was hard for startups, scale-ups, and even early enterprises to compete with this. Tracksuit, the New Zealand-founded scaleup, is changing this, though, with always-on brand tracking. And they are growing like a rocket ship.

It’s my job today to tell their story through founders Connor Archbold and Matthew Herbert, along with color commentary from employee numero uno, Mikayla Hopkins, and Tyson Lloyd, who leads partnerships at the company. Tracksuit is one of the fastest-growing companies you’ll find, racing to $42 million of ARR in five years. This is a wild one, so buckle up and hang on tight.

How brand has been tracked historically

For decades, brand tracking was the exclusive domain of massive consultancies; Kantar, Nielsen, and a handful of Don Draper’s favorite firms served only the world's largest companies. These reports were stale—often reporting on what happened six months ago—stodgy and expensive. Stodginess-wise (first use of this term), the reports were delivered through hundred-page slide decks filled with charts and data. The type of stuff someone flicks through for a few minutes, then throws in the waste paper basket.

When it comes to expense, companies would really only pay for brand tracking at the highest end of town. Today, a brand tracking report might come from a McKinsey, with a sticker price of $200k. Not the stuff of scaleup, mid-market, or even budding enterprise buyers. What I am trying to say here is, unless you were a Madison Avenue type, brand tracking barely existed.

In the 1950s and 60s, Nielsen handled radio and TV audience measurement, Gallup did some survey pseudoscience; by the 70s and 80s, psychology entered the chat. ‘Brand equity’ was abuzz; Milward Brown and Interbrand were becoming large-scale global branding agencies.

|  |

Things have moved forward considerably since the 80s, with the 90s and 2000s bringing us emotional associations, brand attributes, and the Net Promoter Score. Most recently, in the 2010s, it all became about what insights Google and Meta could serve you on the performance side. Brand tracking hadn’t died by this point, but it certainly had become the smelly, pimple-laden stepchild of growth.

The revival (/future) of brand tracking would come through an unlikely source: two cavorting Kiwi co-founders, Connor and Matt, and a very simple insight they shared: “Why is brand tracking not as accessible as performance marketing?”

Validation before building + Trojan warlords

"What we saw was that marketing really has two jobs: harvesting existing demand and creating future demand,” Matt would tell me during our interview, “Performance marketing is great at the first, but brand marketing is what brings new people into the category and builds familiarity over time.”

Armed with this idea in mind, and tightening performance marketing across the industry, Matt and Connor—along with equity partners James Hurman (a world-class brand strategist), and TRA (a leading NZ research agency)—were tasked with pounding the pavement to understand the pain points of marketing teams across New Zealand. In order to make this happen, they listed out ~100 marketers and agency people who regularly interacted with brand tracking. Then they started talking to them one by one with zero product built. They had a strict validation goal that they needed at least 10 committed beta customers before building anything.

We told ourselves we wouldn't build the product unless we could get at least 10 people to commit in advance and effectively sign on as beta customers. In the first 20 conversations, people were polite but non-committal, so we kept refining how we explained the problem and the solution. By the 68th conversation, we had our 11th customer sign up for a full year of brand tracking.

This was enough immediate validation. There was something there. Thirty days after securing commitments from 10 brands, Tracksuit delivered its first working product: a brand dashboard built on Power BI. Scrappiness badge = secured.

Once the thesis was in play, the goal was set. The team would aim to hit $1 million in ARR in the first 18 months of operations. Their God Metric on their way to this lofty revenue target was not pipeline, leads, or deals closed, but rather conversations per week. "In the first year, we measured success by the number of conversations. Our entire go-to-market motion was: go out and speak to every single person who we believed had this problem,” OG employee Mikayla Hopkins, who now leads marketing, would tell me.

*The photo below depicts four Tracksuited vagabonds around six months into Tracksuits journey. Is it possible to dogfood a company name?

So that’s what they did. They ran surveys themselves, pushing data into their white-labelled Power BI setup. Owning their own platform wasn’t important; validating that they could create value was. Two interesting insights throughout this stage were, firstly, that they ran onboarding in quarterly cohorts, allowing them to totally reshape the product from feedback of previous batches.

And secondly, that they ran this whole adventure as what I’m calling Operation Tracksuit Horse. "A lot of those early calls were framed as learning conversations and problem discovery rather than formal sales meetings,” says Mikayla, “The focus was on understanding what hurt and what they were trying to achieve, more than trying to push a product." What happened, of course, was both. They built a set of early insights that helped them shape the product, while also building a pipeline of who would eventually be their beta customers. This is what others in the industry call ‘sneaking in the back door.’

And the ancient warlords of Troy would be proud. This warm and cozy, enter via the backdoor, ramen-noodle-Power BI approach was working. "At that point, Tracksuit had seven customers. It had just been Matt and Connor swinging wireframes and selling the dream. They were at about $100k ARR, roughly six months into the journey," per Mikayla’s recollection of her earliest days.

But there was one more move that would define Tracksuit's early brand identity, which had nothing to do with dashboards. Remember, this company is called Tracksuit. And from day one, they leaned into it with the subtlety of a sledgehammer. When Mikayla joined as employee number four, one of her first tasks was packing gray tracksuits into bags and hand-delivering them to early customers and supporters around Auckland. Connor was the getaway driver, and apparently a bad one, as the image below depicts.

Running on fumes. |

This wasn't a merch play. It was what Mikayla calls the ‘t-shirt theory,’ most famously applied by early Bumble, when people were proud to walk down the street in a Bumble tee because it signaled something about who they were and what they believed in. Tracksuit wanted the same thing: wear the tracksuit, tell the world you care about building great businesses.

"We weren't just selling brand tracking," Mikayla told me. "We were selling career and social currency. If you use Tracksuit, it makes you a better marketer. That leads to promotions, more budget, bigger teams, more resources. We wanted people to feel part of something that was going to change how we think about the commercial side of brand."

Source: Google.

It worked. Customers started posting photos in their tracksuits on LinkedIn. People who weren't customers started fighting to get their hands on a set. It created this beautiful flywheel: great product → community pride → organic visibility → more conversations → more customers. The UGC was a consequence, not the objective. And LinkedIn, where every marketing nerd lives and breathes, was the perfect stage for it.

Oh, and before we move on: Remember the initial goal of Tracksuit getting to $1 million ARR in 18 months? They did it in nine.

Daylight → Tracksuit

Before we go any further, I need to address something I know is on your mind: why the Tracksuits? Well, the company's original name was Daylight, with the idea of ‘bringing brand data into the daylight.’ But it just didn’t suit them, as the founding team is very relaxed, laid-back folks, who enjoy engaging in what Kiwis, Aussies, and the Brits call ‘banter.’ For our readers in the United States, this concept may be somewhat foreign to you. Wikipedia describes it as “the playful and friendly exchange of teasing remarks.” (I just used it on you, dear Yankee)

For a deeper understanding of the phenomenon, I have included the Urban Dictionary definition along with a great example of playful, self-deprecating Kiwi humor to its right.

Given that the founders felt Daylight was a bit stuffy, they needed something that better reflected them. They landed on the name Tracksuit because: 1) it was the antithesis of the typical industry ‘suit,’ 2) because it had the ‘track’ in ‘brand tracking’ in it, and 3) for no other reason than it just felt right.

The name Tracksuit came from how we wanted to position ourselves against traditional market research firms. They're the suits; we're the tracksuits. We're built for speed and comfort.

Culture eats strategy for breakfast

I asked Matt what Tracksuit did well in these earliest of days, and I found his answer very interesting. Here beneath is the full transcript.

Doc (me): “So Matt, what was the most successful thing you did in the zero-to-one stage if you had put your finger on it?”

Matt: “Three things made the biggest difference in the zero-to-one stage.

First, we got clear on why we were building the business. Early on, we brought the team into a room and aligned on what success meant, tangibly and intangibly. That clarity gave us a reference point for decision-making as we grew and helped people understand how their work contributed to where we were going.

Second, we defined our core values early. We treated the company as a blank canvas and were deliberate about the culture we wanted to build. Those values became the foundation for how we hired, rewarded people, and held ourselves accountable, and they’ve stayed consistent as the team has grown.

Third, we spoke to the market constantly. We made the number of conversations we were having with customers, advisors, and partners a key metric. That feedback helped us validate ideas early, avoid building in a vacuum, and stay tightly aligned with what the market actually needed.”

Doc (me again): “What came out of the early ‘why are we here?’ alignment exercise?”

Matt (again): ”The exercise helped us find common ground across what people wanted, both personally and professionally. On the intangible side, we aligned on wanting to make a meaningful, long-term impact on how businesses grow by connecting strong brand strategy with better business outcomes. We also cared deeply about building a team and a place of work people were genuinely proud of, where they felt like ambassadors for what we were building.

On the tangible side, we set clear early goalposts. We wanted to build a globally recognized technology company out of Australia and New Zealand, create opportunities for local talent, and prove we could scale through the difficult early stages of growth. We aligned on getting to around ten million in recurring revenue, serving a thousand customers, and building a business with real long-term value. That shared clarity gave us direction and helped guide decisions as the company evolved.”

Doc: “Matt, can I have a job at Tracksuit?”

Matt: “No, Doc, no, you cannot.”

Okay, I made that last part of the interaction up, but it does sound like a place you’d want to work, right? Thoughtfulness like this, in my experience, is the exception, not the rule. And it’s no wonder Tracksuit peeps are so passionate about where they work.

Bootstrap begone (Series A)

The team at Tracksuit did something rare to begin; they bootstrapped the company from day one. Because they didn’t build, hire, execute until they had demand, and therefore paying customers, they were running cash-flow positive. Connor shared with me that, "Bootstrapping can go two ways: you either chase any revenue you can find and accidentally become a services business, or you stay disciplined. We chose the second path. We committed to a clear hypothesis, only did the thing we believed in, and kept iterating on that one idea."

The early channels were really focused heavily on brand building for Tracksuit, highlighted by a flagship event series the team ran called Building Brands of the Future. “We wanted to be elite but not elitist, so we would hand-pick the people we wanted in the room,” per Mikayla, “Those people would go on to tell our story for us. They would post on LinkedIn and let their network know they were invited into a room of some of the best brand minds in the country. That helped us very quickly create broad awareness of Tracksuit.”

Funnel stage | What | How (much) |

|---|---|---|

Brand building (creating future demand) | Events, creator partnerships. earned media, storytelling. | 70% |

Conversion activity (harvesting existing demand) | Paid acquisition etc. | 30% |

Another channel they leaned heavily into was creator partnerships, with the takeaway being that people cared deeply about career and social currency. “If you use Tracksuit, it makes you a better marketer. That leads to promotions, increased marketing budgets, larger teams, greater resources, and exponential growth within a company. LinkedIn was the perfect channel to tell those stories,” Mikayla told me.

But it didn’t always work. Mikayla said it was one of the hardest channels to get right, and that “there was a lot of wastage,” but as the program progressed, Tracksuit and the team were able to separate the wheat from the chaff, until they landed on a small set of creators, and a quality over quantity approach that worked for them.

Source: Tracksuit.

Source: Tracksuit. |  Source: Tracksuit. |

However, it wasn’t all rosy in the Land of the Long White Cloud, as anyone who has bootstrapped a company before knows that no matter how well you are going, brutal cash flow crunches are always just around the corner. “A slow-motion knife fight,” I’ve heard it referred to as in the past.

The most stressful periods came from bootstrapping while growing very quickly. We were hiring ahead of revenue, closing lots of deals, but invoices don't always get paid on time. There were a couple of moments where Matt and I were staring down payroll with almost nothing in the bank, despite having hundreds of thousands in receivables that simply hadn't landed yet.

”In one of those situations,” Connor shared, “We ended up taking what I'd call a very 'spicy' loan; not something I'd generally recommend. Our credit cards were maxed out, there was no cash available, and we needed to make payroll that week."

”One of the toughest moments,” Matt recalled of this experience, “We had a team of around 15 people and came very close to not making payroll. Cash was tight, company cards were maxed out, and the responsibility of supporting the team weighed heavily.” This led the team to pursue some seed capital, in a round of $7.5M led by Blackbird, with support from Icehouse Ventures, Ascension, and Shasta Ventures. This was followed exactly 12 months later when Altos Ventures led the companies $13.5M Series A. The company had ~$10 million in ARR at the time.

When we did raise capital, it was about fueling the next phase of growth rather than staying alive. Coming out of the pandemic, investors were focused on profitability and strong fundamentals, which played to our strengths.

These capital raises not only secured the footing of Tracksuit, but set them on a new trajectory. Bootstrapped companies have the optionality of building a beautiful, cash flowing business, VC-backing means it’s scale or bust. Luckily for the team at Tracksuit, they had incredible momentum, an ever-extending runway, and were about to double down on their most interesting growth channel.

Platform stickiness + borrowing another Kiwi playbook

“Good artists copy, great artists steal,” if you ask Pablo Picasso, and Tracksuit, being the new darling of the New Zealand tech scene, has borrowed much and more from another Kiwi tech success, Xero. The similarities are vast, but the most important similarity and therefore borrowed strategy is Xero’s accountancy playbook.

Xero, for those who don’t know, are a major player in the bookkeeping space. Due to this, they sell to two types of buyers: one is the enterprise single buyer, and the other is accountancy firms. The latter allows them to sell once, yet distribute hundreds, or sometimes thousands of times.

Tyson, whom I interviewed for this piece, recognized the similarities firsthand after spending the best part of a decade at Xero. "Tracksuit took something that was traditionally complex, expensive, and out of reach for many brands, and basically democratized access to brand tracking with a simple, affordable, beautiful, and intuitive dashboard. That's basically what Xero did in the accounting space." But it wasn’t only that, "From a go-to-market motion, I see a lot of similarities in the way Tracksuit works with agency partners too. Agencies around the world work closely with brands. They have trusted relationships, help refine marketing strategies, and advise on where to invest marketing funds. Just like Xero did."

Source: Growth Gauge (with my artistic touch).

Mikayla would profess her love for the channel as well when she told me, "Agencies at the moment honestly deliver about one third of our revenue at the company. Instead of selling one-to-one, we can sell one-to-many. These incredible agencies—usually in the creative space—become our best sellers. They advocate for the work they're doing, and if an agency has ten customers, all ten can end up using Tracksuit.”

The agency channel has slightly different economics, allowing agencies to pass savings to clients or absorb them themselves. Most pass it on. Tracksuit gets reach, agencies get a commission + data to communicate their value, and clients get insights that prove what they are doing is working.

Tracksuit gives us the opportunity to have more regular conversations about brand performance with our clients. The real-time data, presented in an intuitive format and at an affordable price-point is a game-changer. It makes it easier to uncover insights that lead to new opportunities and projects — ultimately increasing the performance of the brands we work on.

Other companies that use a similar strategy include HubSpot with the Solutions Partner Program, Klayvio selling through Shopify agency partners, and Google and Meta, which both run agency partner programs in which agencies manage ad spend on behalf of brands.

Tyson's insight on where this goes next is towards deeper, Tier 1 partnerships with brands like Google and TikTok, which are deeply embedded in marketers' workflows. Joint research studies, brand health data sharing, platform integrations, measurement gap solutions. Tracksuit has the ambition to become the most interoperable brand-tracking platform. If they are successful, the platform will become very ‘sticky’, a term that VCs love. Platform ‘stickiness’ happens when a company adds significant value and is embedded in so many core areas of the business that it’s difficult for users to live without.

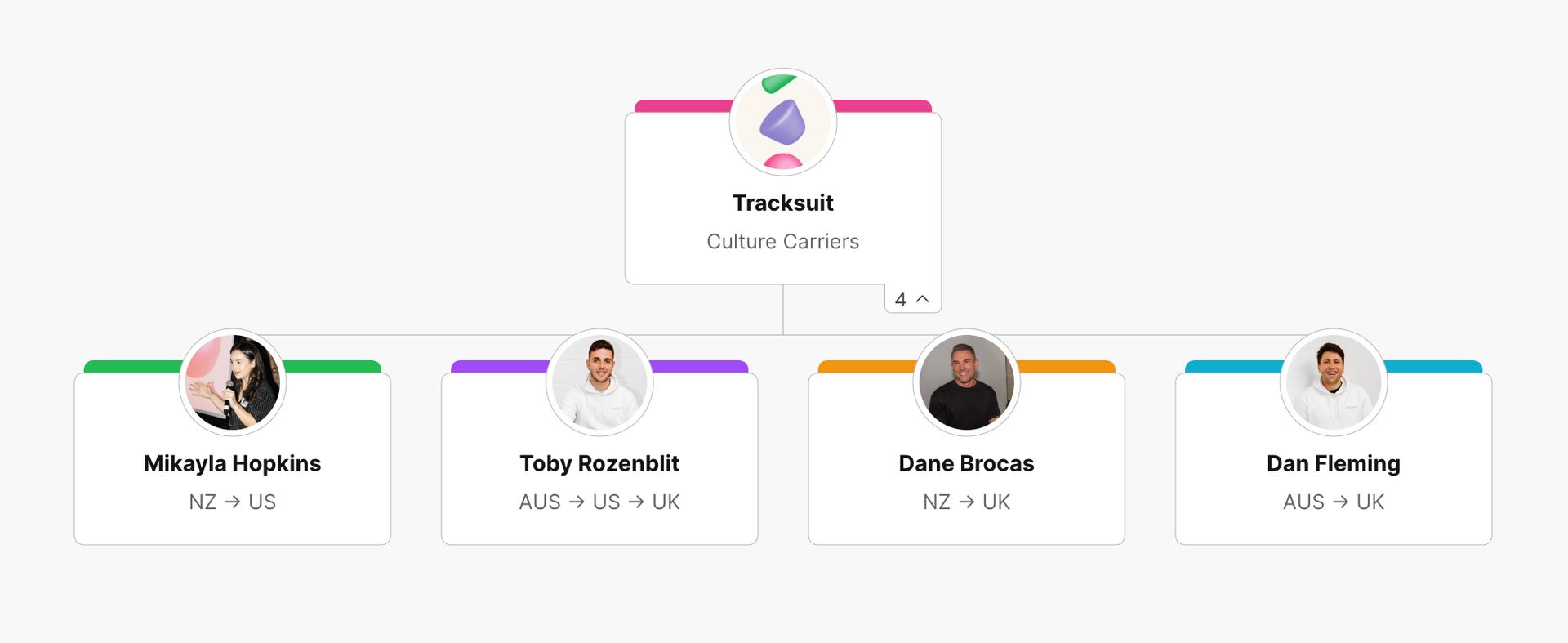

Culture carriers + expanding the global footprint

Something I really loved learning about was Tracksuit's geographic expansion and how they succeeded by sending ‘culture carriers’ to seed new locations. Connor loosely defined it as: someone who embodies the company's values without having to think about it; it just comes naturally to them.

Geo expansion rollout order, looking something like this: New Zealand in year one, Australia in year two, followed by the U.S. and U.K. at the end of year two and three. They have yet to have boots down everywhere, but the brand now tracks 27 markets, driven by European demand for multi-country tracking.

Passers of the flame.

The playbook for rolling out a location was simple: seed the region with cultural rocks and treat it like a fresh, bootstrapped company. In order to make this happen, the MVP team was a customer success person, a sales hire, and another supporting marketing. That triad is the foundation for every new market. In the UK specifically, they found that a strong generalist / GM-type hire who could own the market end-to-end was very effective.

Scaling through chaos (Series B)

Even though Tracksuit was crushing it from all angles, times were often tough on the inside. Founder Matt, for example, went through a period of heavy burnout in mid 2024. After several years of foot-to-the-floor growth-wise, moving from Auckland → London, managing multiple markets, constant travel, working across time zones, he hit burnout "hard and fast" and had to take time off. "It caught up with me," he said, "A real wake-up call."

Come June 2025, this ragtag bunch of Kiwi misfits, along with their 150 employees across NYC, London, Sydney, and Auckland, had landed themselves their Series B. A $25M round led by VMG Partners. By this point in our story, Tracksuit has 1,000+ customers, 240% YoY growth in the U.S. to boast of, and is tracking more than 10,000 brands.

The problem now was not what to do but what not to do. When speaking to Mikayla, it became apparent that one of the toughest things about this type of momentum was the constant fight against optionality. "We had moments where we got excited by lots of different opportunities. There was this path over here, another path over there. We've had to get much better at saying no to 99.9% of opportunities."

With their newfound, narrowed focus, Tracksuit has been able to double down on what works. Across multiple geographies, the channels they focus on are remarkably straightforward and simple.

Channel | What | How (much) |

|---|---|---|

Inbound | Obvious. | 30% |

Outbound | AE-led outbound. Also obvious | 17% |

Partnerships | Channel partnerships, will deep dive in the next section. | 25% |

Referral (personal) | Obvious. | ~9% |

Expansion | Happy people giving them more money. | 18% |

*Yes, yes, I know this adds up to a total of 99%. This is what Mikayla gave me, don’t shoot the messenger (and sorry Mikayla for throwing you under the bus here).

But clean channel math doesn't capture what scaling actually feels like from the inside. Because here's the thing nobody tells you about international expansion: you don't just export what works. Sometimes you have to rebuild it. When Tracksuit first entered the U.S., they assumed the product that had carved through New Zealand and Australia would translate directly. It didn't. |

American marketers didn't just want national brand tracking; they needed regional granularity. Seattle versus Texas versus the Midwest. Regional tracking wasn't a nice-to-have; it was table stakes. And the product didn't support it. "The U.S. was harder than expected. We'd built for a simple market, and American marketers needed more granularity. It took real effort to achieve product-market fit there," Connor would tell me during our call. They went from tracking brands in a handful of markets to a total of 27, and while the headline was ‘Tracksuit expands globally,’ the reality was closer to: Tracksuit discovers it needs to re-earn product-market fit in every new region it enters. The dashboard looked the same. The work behind it didn't.

The U.S. forced them to build what would become the platform's biggest competitive advantage. That regional granularity they had to add? European customers needed it even more; not just UK data, but tracking across France, Germany, Spain, Italy, all at once. The painful rebuild for the American market became the foundation for global scale. And it shows: at the time of our interview, Tracksuit had $42 million in annual recurring revenue. |

Playbook / how you can apply this

Validate with wallets, not words: Tracksuit wouldn't build until 10 customers committed upfront. By conversation 68, they had 11 signed to annual contracts. Then they built.

Track conversations, not pipeline: The only early metric was conversations per week. Not leads, not MQLs. Every hire, customer, and positioning insight came from those calls.

Launch in cohorts, rebuild in between: Quarterly customer cohorts let them ship, learn, and rebuild the product before the next group is onboarded. Structured iteration at speed.

Hire ICs who just became managers: Connor's ‘unicorn’ profile: high-performers who recently stepped into leading small teams. Close enough to the work, senior enough to scale with you.

Seed new markets with culture carriers: Founders physically moved to open every office. Early employees relocated voluntarily. Local hires were built around that cultural nucleus, not the other way around.

Let your channel strategy find you: Tracksuit didn't target agencies; agencies came inbound. They now deliver a third of revenue. Stay open to emergent distribution you didn't plan for.

Build your B2B brand like a consumer brand: Tracksuit merch, exclusive events, LinkedIn as social currency. They weren't selling dashboards; they were selling career capital and community belonging.

Future

Tracksuit didn't set out to be a dashboard company. They set out to change how businesses think about brand. And if the next chapter plays out the way the team intends, the dashboard becomes the least interesting part of the story, as sitting underneath all of this is one of the largest brand health datasets on the planet: 10,000 brands across 27 markets, with plans to double. That's not just a product moat. That's a data flywheel that gets more valuable with every customer added.

The team’s north star hasn't changed since conversation number one: get brand data into every boardroom. The difference now is they actually have the dataset, the distribution, and the dollars to do it. And these crazy Kiwi founders just might have the moxie to pull it off.

Fun facts

Lenny Rachitsky is an investor: "Across the thousands of startup decks I've looked at, I've almost never seen a growth trajectory like the growth Tracksuit has seen."

Mark Ritson (marketing professor) is also formal advisor and investor: His quote: "It is easy to lose track of all the marketing startups... But I am genuinely excited about Tracksuit and what it can achieve."

COVID was their talent arbitrage: When high-quality Kiwis returned home during the pandemic, Tracksuit snapped them up. Hamish (now CRO) was one of those people returning from the UK.

7 to 27 markets in a couple of months. European demand for multi-country tracking forced a rapid expansion of their survey infrastructure.

Extra reading / learning

How to find THE soulmate for startup - January, 2025

Nike’s Fall From Grace & Super Bowl Comeback - April, 2025

Brand Breakdown: Does Liquid Death’s Brand Convert? - July, 2025

How Tracksuit turned brand data into a global growth engine - November, 2025

And that's it! You can connect on LinkedIn with Connor, Matt, Mikayla, and Tyson, and don’t forget to check out Tracksuit while you’re at it.

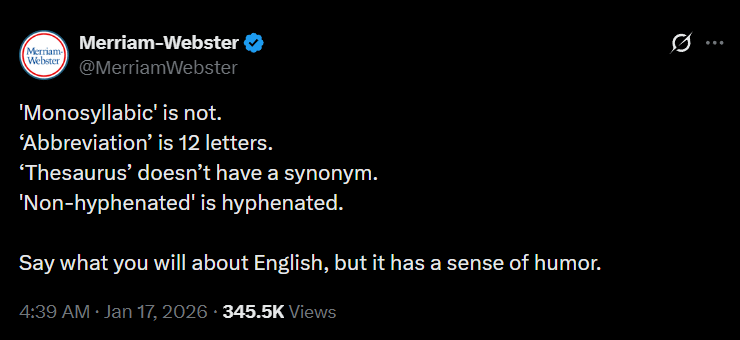

BRAIN FOOD 🧠

TWEETS OF THE WEEK 🐣

TOOLS WE RECOMMEND 🛠️

Every week, we highlight tools we like and those we actually use inside our business and give them an honest review. Today, we are highlighting Vanta*—the security and compliance platform companies rely on to stay audit-ready without losing their sanity.

See the full set of tools we use inside of Athyna & Open Source CEO here.

HOW I CAN HELP 🥳

P.S. Want to work together?

Hiring global talent: If you’re hiring tech, business or ops talent and want to do it 80% less, check out my startup, Athyna. 🌏

See my tech stack: Find our suite of tools & resources for both this newsletter and Athyna here. 🧰

Reach an audience of tech leaders: Advertise with us if you want to get in front of founders, investors and leaders in tech. 👀

|

Reply